ABOUT STOR-AGE

| SNAPSHOT | |

| Listing date | November 2015 |

| JSE sector | Speciality REITs |

| Profile | Highly specialised, low risk, income paying self storage REIT |

| Self storage universe | 9 publicly traded self storage REITs (US: 5, UK: 2, Aus: 1, SA: 1) |

| Market capitalisation | R3.9 billion1 |

| Total | South Africa | United Kingdom | |

| Total property value | R3.9bn | R2.5bn | R1.4bn |

| Number of properties2 | 50 | 36 | 14 |

| Total number of customers2 | 23 500+ | 17 000+ | 6 500+ |

| Total GLA | 321 000 m² | 264 000 m² | 57 000 m² |

| Occupancy | 84.1% | 85.2% | 78.2% |

| LTV | 16.1% | 9.1% | 28.6% |

| 1 | 31 March 2018 |

| 2 | Includes All-Store – acquired 6 April 2018 |

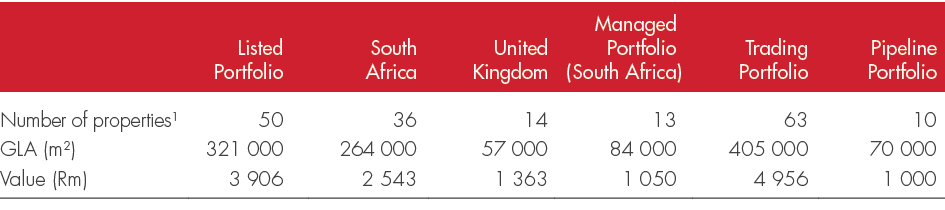

Stor-Age is the leading and largest self storage property fund and brand in South Africa, and the first and only self storage Real Estate Investment Trust (REIT) listed on any emerging market exchange. During the period, we made a strategic entry into the UK market with the acquisition of Storage King – the sixth largest self storage brand in the UK. Our Listed Portfolio comprises 50 properties across South Africa and the UK, with a combined value of over R3.9 billion.

Our highly specialised business focuses on the fast-growing self storage sector – a niche subsector of the broader commercial property market. Stor-Age develops, acquires and manages high-quality self storage properties, which enable us to compete strongly in new market segments and grow our market share. This allows us to benefit from economies of scale and produce favourable operating margins. The REIT company is managed internally.

Our South African portfolio comprises 49 properties, totalling 348 000 m2. Stor-Age owns and operates 36 of these properties, covering 264 000 m2 GLA and R2.5 billion in value (Listed Portfolio). The balance makes up the unlisted Managed Portfolio (84 000 m2 GLA), from which Stor-Age receives property and asset management fees and over which it holds a pre-emptive right of acquisition. In the UK, Stor-Age owns a 97.4% majority interest in Storage King, comprising 14 properties with 57 000 m² GLA and R1.4 billion in value.

DYNAMIC SELF STORAGE SECTOR SPECIALISTS

Leading and largest self storage property fund in South Africa, with a recent strategic entry into the UK

High-quality properties, with excellent visibility and easy access from arterial roads

Outstanding locations with high barriers to entry

Business model based on global best practice

Development capability and innovation

Market-leading operations and digital platform

Decade-long track record of developing, tenanting and operating self storage assets

| 1 | Includes All-Store – acquired 6 April 2018 |

OUR INVESTMENT CASE

- Dynamic sector specialists, allowing for focused attention

- Track record of growing investor returns

- Recession-resilient sector: self storage is a niche asset class uncorrelated to traditional property drivers

- Attractive forecast distribution growth, underpinned by robust self storage metrics

- Secured pipeline of acquisition and development opportunities

- Proven ability to identify, close and integrate value-add acquisitions

- Strong cash flow

- Favourable operating margins

- Attractive earnings growth

- Healthy balance sheet and conservative gearing

- Low bad debt record (< 0.5% of revenue)

- Low obsolescence and ongoing maintenance capex

- High barriers to entry in key target locations

is underpinned by

Our success drivers

- Diversified tenant risk (23 500+ tenants across South Africa and the UK)

- Presence in South Africa’s main metropolitan centres – Johannesburg, Tshwane, Cape Town and Durban

- Prominent locations on main roads or arterials, with high visibility to passing traffic

- Committed and passionate employees

- UK management team with significant self storage operations experience, proven local expertise and a well-located property portfolio

- Average length of stay in South Africa – 24 months

- Average length of stay in UK – 13.5 months

- Growing demand and awareness among customers

- Strong customer satisfaction, with customer service rated as “world class” according to the global Net Promoter Score (“NPS”) standard

- In South Africa, 54% (2017: 53%) of customers store for more than one year

- In the UK, 51% of customers store for more than one year

and

Our Vision

To be the best self storage business in the world

Our Mission

To rent space

OUR CORE VALUES

Excellence • Sustainability • Relevance • Integrity