CEO’s report

A highly specialised and low-risk income-paying self storage REIT, Stor-Age again delivered an excellent set of financial results for the year ended March 2019. This was underpinned by organic growth in our South African and UK portfolios, strategic integration of acquisitions and our ability to execute asset and revenue management initiatives to enhance our value proposition.

We remain sector leaders in South Africa, offering a property portfolio that is unmatched in value, lettable area, number of tenants, location and geographic footprint. Our strict focus on growing the portfolio with properties that display excellent fundamentals continues to be a hallmark underpinning our success.

Stor-Age’s performance is characterised by an attractive level of dividend growth since listing in 2015 and the ongoing and disciplined execution of our current five-year strategy. The acquisition of the Managed Portfolio cements our market-leading position in South Africa, while the conclusion of two high-quality acquisitions in the UK demonstrates our ability to supplement the attractive organic growth delivered by our existing business, Storage King.

Our performance

Our total shareholder distribution of R388 million translated into a dividend per share of 106.68 cents. This represents 9.05% growth compared to 97.83 cents in the prior period. Distribution growth was driven by like-for-like growth in rental income and net property operating income of 7.5% and 7.3% respectively.

The group’s solid trading performance reflects the highly defensive and resilient nature of our business model and the excellent quality of our underlying property portfolio. This is evidenced by the level of enquiries we continue to generate and receive in South Africa and the UK.

Our unrelenting focus on maintaining a healthy, conservatively geared and hedged balance sheet remains a priority for the group. We made progress in this regard with the completion of two strategic initiatives during the year: we restructured our South African and UK debt facilities and successfully raised equity capital via the completion of two significantly oversubscribed accelerated bookbuilds.

Growing our property portfolio

Stor-Age seeks investment opportunities in high-quality self storage assets where we can achieve strong market penetration, leverage and further benefit from economies of scale, enjoy limited competition and produce high operating margins.

Our current five-year growth plan, now in its fourth year, sets broad targets for 2020. More importantly, it details how and where we intend to execute acquisitions and developments to grow our asset base. This includes strategic planning and execution on a macro and micro level.

South Africa

We continue to identify promising local investment opportunities to expand our South African property portfolio. This includes adding space to existing properties, acquiring trading self storage properties from third parties and incorporating them directly into Stor-Age, and leveraging our proven in-house capability to develop new properties in high-profile, prime locations.

Our Bryanston development was completed below budget and under the (CPC) structure.1 Bryanston offered 3 900 m² GLA when it began trading in September 2018 (phase 1). It has since delivered an exceptionally strong performance, with lease-up exceeding our expectations. The development achieved occupancy gains of 2 900 m², as well as 48% occupancy on full GLA fit-out in the seven months to March 2019. This reflects the viability of our strategy to identify and develop high-quality self storage assets in premium locations where barriers to entry are at their highest.

| 1 | Stor-Age entered into the CPC agreements with Stor-Age Property Holdings Proprietary Limited for the development of its self storage properties in Bryanston and Craighall. The CPC structure reduces the development and lease-up risk for Stor-Age and provides an opportunity to develop high-profile properties in prime locations without diluting the group’s distribution growth profile over the medium term. In addition, the CPC is subject to strict independent and regulatory controls. |

Craighall is currently being developed under the same CPC structure. On completion, the property will have 6 650 m² GLA. The development is progressing according to schedule and is expected to begin trading in August 2019.

We also closed two local acquisitions during the year – All-Store Self Storage and the Managed Portfolio – and successfully acquired three additional properties, which will offer approximately 20 000 m2 GLA, for the future development.

All-Store Self Storage was acquired in April 2018. Located in Cape Town’s northern suburbs, the property offered an additional 6 100 m² GLA. To enhance the value of this property, we immediately sought to upgrade its retail interface and enhance its kerb appeal to passing traffic. We also developed an additional 1 600 m² GLA.

A strategic milestone was the acquisition of the twelve-property Managed Portfolio in October 2018, nine of which are high-profile and all of which are purpose-built.

These properties were previously managed but not owned by Stor-Age as they were either under development or in the lease-up phase at the time of our listing. In the short to medium term, these properties would therefore have been dilutionary and negatively impacted the group’s distribution growth profile – thereby putting at risk our intention to bring a highly specialised and low-risk income-paying self storage REIT to market.2

| 2 | The development of new self storage properties is subject to lease-up risk as space cannot be pre-let prior to the development being completed. Additionally, lead times to reach stable and mature occupancy can typically range from three to five years. |

As such, the properties remained under the ownership of the three joint venture partners. As the portfolio approached an appropriate level of maturity and met our objective to deliver attractive and stable income returns, Stor-Age successfully acquired the portfolio in an efficient manner, making it attractive for shareholders.

The acquisition of the Managed Portfolio at an average occupancy of 73% was in line with what we communicated to the market at the time of our listing, demonstrating consistent strategy execution. Following the acquisition, the business benefits from a streamlined ownership structure.

The Managed Portfolio comprises a majority of bespoke Big Box self storage properties and added an additional 86 700 m² GLA to the group’s existing portfolio. Since acquisition, occupancy has grown by 4 400 m² and ended the year at 80.1% on a full fit-out basis.

The properties are mostly located in prime areas in South Africa’s four main cities. Given the prime locations, the challenges to obtain the necessary town planning consents and the significant period of time required to develop and then lease-up the properties, it would be extremely difficult to replicate a portfolio of self storage properties like those in the Managed Portfolio over the short to medium term. Stor-Age therefore not only benefits from promising growth opportunities, but the acquisition also cements our presence within the four major metropoles and entrenches our position of market leadership in South Africa.

United Kingdom

In November 2017, we made a strategic entry into the UK self storage market with the acquisition of Storage King – the sixth largest UK self storage brand. At the time, we identified that the in-place Storage King management team had significant operating experience and a thorough understanding of the intricacies of the UK self storage market. In addition, they possessed deep industry connectivity and a successful track record of sourcing off-market acquisition opportunities.

Post acquisition, we identified high-impact focus areas to extract maximum growth from our newly acquired platform. These included support services run from our Stor-Age head office in South Africa that we could integrate into our UK business. We also implemented a digital marketing strategy to boost Storage King’s online visibility.

We were particularly successful in leveraging our in-house digital marketing capability to drive Storage King’s online enquiry generation during the year.

This remains the lifeblood of any self storage business and is particularly important in the UK market which, despite the relative lack of supply in comparison to first-world peers such as the US and Australia, remains fiercely competitive. On the back of the improved enquiry generation, occupied space increased by 8 400 m² year on year, including like-for-like growth of 1 300 m². This resulted in closing occupancy of 80.3% and growth in like-for-like net property operating income of 6.3%.

We continue to identify additional opportunities to integrate our South African and UK businesses. Our online learning and development platform, Edu-Space, was made available to our UK-based employees during the year. As part of a first phase roll-out, we also expanded our contact centre into the UK market, with overflow calls from a select number of trading stores redirected to South Africa. Based on the success of this initiative to date, we will expand the support service to all of our UK trading properties.

As true sector specialists, the ability to seamlessly transport our online capability across borders assists us in continuing to unlock value for shareholders and remains a significant strength regardless of where we operate.

Progress made since the strategic entry into the UK has ensured a scalable and robust platform to sustainably manage our offshore expansion. In particular, the greater maturity of the UK self storage market relative to South Africa offers significant opportunity for meaningful growth through consolidation as we continue to see growing levels of demand for self storage.

Leveraging the existing relationships of Storage King’s management, we acquired two UK-based trading properties off-market in March 2019: Viking Self Storage and The Storage Pod. Both acquisitions are mature, high-quality freehold self storage properties that trade into dense residential areas and in locations complementary to the existing Storage King portfolio. The properties, with attractive average rental rates and high occupancy levels, will be rebranded under Storage King and managed off the existing operating infrastructure.

The acquisition of Viking Self Storage in Bedford added 4 500 m² GLA to the group’s existing portfolio, with the opportunity to expand this to 5 000 m². The Storage Pod in Surrey offered a similar acquisition opportunity, featuring a GLA of 4 000 m² and an MLA of 5 100 m².

Combined, these acquisitions have increased the number of trading properties in our UK portfolio to 16 and the number trading under the Storage King brand to 28.3 This is in line with our stated growth and investment strategy within the region and will supplement the robust performance delivered by Storage King to date.

| 3 | An additional 12 properties trade under licence of the Storage King brand, taking the total number of Storage King branded properties up to 28 across the UK. |

Despite the uncertainty of Brexit, we anticipate this positive momentum to continue and we remain focused on achieving organic revenue growth by increasing occupancy and rental rates, underpinned by a strong operating platform.

Technology as a business enabler

While visibility remains critical to drive enquiry generation among potential self storage users, a strong online presence, contemporary web user experience and highly effective multichannel online sales platform are equally important. Online enquiries represent 65% (2018: 57%) of all enquiries in our South African business and 87% (2018: 85%) in our UK business.

We continue to enjoy significant online visibility on Google and benefit from being one of the most actively followed self storage businesses on Facebook in the world.

The ability to harness the global omnipresence of these and similar platforms demonstrates the strength of our in-house digital marketing capability. We continue to invest significant time and resources to ensure we are appropriately positioned, and this will remain a strategic focus area going forward.

A big focus during the year was the development of our multiyear digital strategy, which will guide Stor-Age’s digital transformation over the medium term. This strategy will help ensure we remain responsive to shifting consumer trends as well as the current rate and pace of technological change and innovation within our own sector and society more broadly. It will also guide resource allocation and our investment in digital technology.

Sustainability as a business enabler

We continue to reduce our carbon footprint. All of our South African properties are fitted with LED lighting, and Stor-Age was the first South African self storage company to install solar technology for three-phase power generation. Phase one of our solar photovoltaic installations included four properties and, in the upcoming financial year, we will add an additional 16 properties as part of phase two. To support water saving, we harvest rain water at all of our 49 properties in South Africa.

Our people

Our exceptional team of dedicated, high-calibre employees are fundamental to and drive the ongoing growth and success of our business.

We recognise the need to maintain a motivated and engaged workforce, and we continue to excel in this arena. The results of our annual anonymous staff survey once again indicated that 95% of our employees are proud to form part of the Stor-Age team.

With our roots firmly embedded as a capital-light start-up, we have an entrepreneurial culture at our core. Post listing in 2015, we have worked hard to remain nimble and responsive, while balancing the need to introduce enhanced organisational frameworks and structures to support sustainable growth.

We are also aware that ours is a developing business operating in a global growth sector. Ongoing training, learning and development will therefore only become more important as our business increases in size and scale. In particular, it is critical that our employees remain engaged and equipped with the competencies required to remain competitive – with a strong focus on customer service and superior selling skills at point of sale to earn the trust of customers visiting our properties. These skills are also important to secure move-ins at the right price to optimise revenues.

The training and development of our store-based and customer-facing colleagues therefore remains an essential part of our business and is at the heart of our entrepreneurial culture.

We continue to invest in our in-house, bespoke learning and development programme, underpinned by a strategic focus on technology. We recorded more than 1 000 hours of training across 45 separate modules on Edu-Space, our online Learner Management Platform. We also engaged LinkedIn Learning during the year, an online, on-demand learning platform for senior managers and functional teams.

In addition, we established a formal management committee (manco) that meets four times during the year to set annual priorities and quarterly action items. This committee also identifies key performance indicators and delineates appropriate channels of accountability. Ultimately, this drives alignment and productivity across the business. Among other priorities, two key items identified by the manco for the upcoming financial year include ongoing development of our middle to senior management and promoting an enhanced sales and customer service culture within the business.

Stor-Age’s outstanding success for over a decade is the result of excellent work by our team of committed and talented people.

Our flat, non-hierarchical structure, with fully accessible management, endeavours to reward all staff members for their contribution to the growth and success of our business.

A highlight during the year was the approval of a CSP by shareholders. All permanent employees are eligible to participate in the CSP. This includes executive directors, senior management, operations managers at the property level and mid-management employees. Not only will the CSP align the interests of the business and our employees, it further supports broad equity participation due to our employee demographics and promotes the continued growth and success of Stor-Age.

Portfolio analysis

Outlook

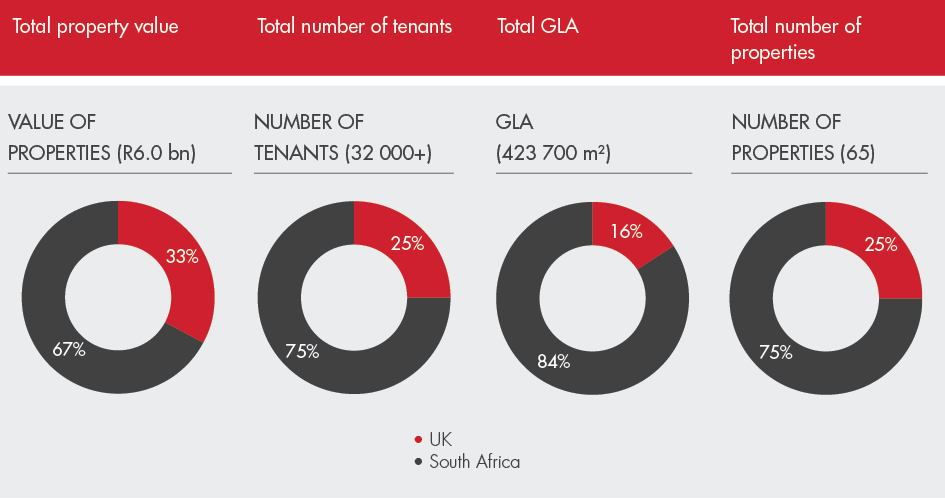

Notwithstanding the UK acquisitions completed during the year, Stor-Age remains a primarily South African-focused business with a targeted UK exposure of between 30% and 40% of our total asset base over the medium term.

In South Africa, we anticipate the constrained macroconditions to persist for at least a further 12 to 18 months. In the UK, the market will most likely continue to operate below its full potential while uncertainty around Brexit remains. Accordingly, the year ahead will necessitate an increased emphasis on active, hands-on management and disciplined operational focus at an individual property level.

Despite this, we continue to benefit from consistent and growing levels of demand in both markets. The growth in demand is supported both by the fluctuation of economic conditions (which has an impact on the make-up of the underlying demand) and by a growing awareness of the product of self storage. Most domestic and business customers require the product either temporarily or permanently for various reasons throughout the economic cycle. This results in a market depth that is, in our opinion, a significant contributing factor towards the resilience of the self storage product.

With the benefit of a robust balance sheet that boasts low levels of gearing and is significantly interest rate hedged, we remain confident in the resilience of our business model and that we will continue to deliver attractive returns.

This will be underpinned by our high-quality property portfolio, outstanding operating platform, deep sector specialisation and many years of sector experience.

Combined, we believe these factors will enable the group to continue pursuing earning-enhancing opportunities and allow us to deliver attractive and sustainable distribution growth for our shareholders.

Acknowledgements

Lastly, I would like to take the opportunity to express my sincere gratitude to the chairman and our board for their continuing support, wisdom, guidance and ongoing advice, not only during the period under review but over the last four years, since our listing.

Gavin Lucas

CEO

11 June 2019