REMUNERATION COMMITTEE REPORT

PART ONE

THE CHAIRMAN’S STATEMENT

The board and remuneration committee are pleased to present the 2019 remuneration report which provides context to how we approach remuneration, sets out our remuneration philosophy and policy, and details the actual outcomes for executive and non-executive directors. This report is aligned to best practice, taking into account King IV and the JSE Listings Requirements.

We have presented the remuneration report in three parts.

INTRODUCTION

The 2019 financial year presented several challenges including a deteriorating macroeconomic environment in South Africa and the continuing uncertainty caused by the timing and terms of the UK’s withdrawal from the EU. Despite these challenges Stor-Age delivered another set of strong trading results and management has proven its ability to successfully execute its business strategy through profitable and sustainable growth.

Our success as sector specialists is highly dependent on developing and retaining exceptional talent. With a focus on competitive, fair and market-related remuneration, the design of our remuneration framework will play a critical role in attracting and incentivising employees who are aligned with our core values and contribute positively to our culture and strategic objectives.

FOCUS AREAS DURING THE YEAR

During the year, the remuneration committee:

- Reviewed the current remuneration structures and remuneration mix against best practice and considered the introduction of both short- and longterm incentives;

- Implemented the Conditional Share Plan (CSP) as approved by the shareholders;

- Engaged with shareholders regarding the remuneration policy and implementation thereof, as well the performance conditions relating to the CSP;

- Approved CSP awards to participants;

- Conducted total remuneration benchmarking for executive directors;

- Reviewed executive directors’ total remuneration, and reviewed and approved salary increases against the market, as well as company and individual performance;

- Reviewed non-executive director remuneration (to be approved by shareholders) with the assistance of the executive directors;

- Reviewed and proposed the company’s malus and clawback policy for approval by the board;

- Considered the concept of fair and responsible remuneration and its application within Stor-Age;

- Reviewed and approved the 2019 remuneration report; and

- Considered methods for the investigation and rectification of pay disparities as the result of equal pay for work of equal value.

The remuneration committee mandated management to obtain the support, advice and opinion of PwC as an external advisor on the implementation of the CSP, external benchmarking and other remunerationrelated matters during the year under review. The assistance of PwC in this regard was satisfactory, and the remuneration committee is of the view that they operated independently.

On 19 February 2019 shareholders approved the company’s CSP. Under the CSP, participants are awarded a right to future delivery of equity (i.e. a conditional right to receive shares). Vesting of shares is subject to the achievement of performance conditions, each with different weightings, and continued employment. The performance period is three years and coincides with the company’s financial year. Further details of the salient features, award levels and performance conditions of the CSP can be found in part two and three of this report.

FOCUS AREAS FOR 2020 AND FORWARD LOOKING CONSIDERATIONS

The executive directors, being the original founders of the business, have played a significant role in the growth and performance of Stor-Age since its listing in November 2015. In March 2018 the remuneration committee mandated PwC to perform an external benchmarking exercise to better understand the remuneration packages within the market that the company operates. This was completed in June 2018 and confirmed that the company’s executive directors’ remuneration is considerably lower than its peers in the listed REIT sector. A primary area of focus is therefore to ensure that executive remuneration is market related and reflective of the roles and responsibilities performed. This includes the consideration of an appropriate short-term incentive scheme for the executive directors.

The remuneration committee will also focus on the retention of key talent and critical skills, particularly at the senior management level, by ensuring that key employees are adequately compensated for their performance and contribution. The development of key senior and middle management staff remains an ongoing priority of the executive directors and the remuneration committee. This is particularly important in the context of succession planning to ensure the development of future leaders as the company continues its growth trajectory.

Lastly, we will also give due consideration to the introduction of a minimum shareholding requirement in relation to the company’s long-term incentive plan in accordance with best practice.

CONCLUSION

At the annual general meeting (AGM) held in 2018 our remuneration policy achieved a non-binding advisory vote of 80.0% in its favour, while the remuneration implementation report received a vote of 90.7% in its favour.

In line with King IV, Stor-Age will table the remuneration policy and implementation report for two separate non-binding advisory votes at the 2019 AGM. If shareholders do not approve both by more than 75%, the board will institute a formal engagement process with interested shareholders to assess their views and determine the actions needed to resolve concerns.

The remuneration committee is satisfied that it fulfilled all its objectives in line with its terms of reference for the year under review. We remain committed to improving our remuneration practices and ensuring alignment between strategy, performance and remuneration to maximise long-term value creation. We welcome any comments or concerns shareholders may have regarding the remuneration policy and implementation report, recognising that our polices and structures will evolve as we receive shareholder feedback over successive reporting periods. Please direct any comments or queries prior to the AGM in writing to the company secretary, Henry Steyn, at henry.steyn@stor-age.co.za.

We look forward to receiving your support on the resolutions for both the remuneration policy and implementation report at the AGM on 22 August 2019.

Gareth Fox

Remuneration committee Chairman

11 June 2019

Part two

THE REMUNERATION POLICY

This remuneration policy is subject to an advisory vote by shareholders at the AGM to be held on 22 August 2019.

REMUNERATION GOVERNANCE

The remuneration committee was appointed by the board and has delegated authority to review and make decisions regarding Stor-Age’s remuneration policy and the implementation thereof. The remuneration committee is governed by its terms of reference as formally adopted by the board. Its responsibilities are to:

- Oversee the board’s formulation, review and approval of the remuneration policy for employees and executive directors in line with Stor-Age’s strategic objectives;

- Assist the board to ensure that executive directors are remunerated fairly and responsibly and in line with remuneration for employees throughout Stor-Age;

- Ensure that the mix of fixed and variable pay in cash, shares and other elements meets the group’s needs and strategic objectives;

- Consider and approve the long-term incentive allocations and awards for the CSP for the executive directors and other staff;

- Approve the executive directors’ basic salary and increases thereto, as well as approving the increases for employees throughout Stor-Age;

- Approve remuneration payable to non-executive directors in their respective roles as members of the board and its subcommittees;

- Oversee the preparation of the remuneration report to ensure that it is clear, concise and transparent; and

- Ensure that the remuneration policy and implementation report be put to two non-binding advisory votes by shareholders and engage with shareholders and other stakeholders on the group’s remuneration philosophy.

The remuneration committee members are listed here and their meeting attendance here. All members of the remuneration committee are independent non-executive directors. Other board members, external consultants and key individuals may attend remuneration committee meetings by invitation and contribute to remuneration-related matters. However, they may not vote on any matters. The remuneration committee chairman reports to the board following each meeting of the remuneration committee.

REMUNERATION PHILOSOPHY

Stor-Age’s remuneration policy seeks to attract and retain high-calibre and appropriately skilled employees and executive directors. Stor-Age’s philosophy is that employees should be fairly remunerated and rewarded for their contribution. An integral part of this philosophy is to align the interests of employees with those of Stor-Age’s shareholders by providing meaningful equity participation. The group believes that its remuneration policy plays a critical role in achieving its strategic objectives and that it should be competitive in the market in which it operates.

REMUNERATION STRUCTURE

Taking into account market trends and competitiveness, the remuneration committee and the board regularly review the appropriate remuneration mix to ensure it supports Stor-Age’s strategic objectives. Currently, the remuneration mix for executive directors consists of a basic salary and participation in the CSP, details of which are set out below.

Basic salary

The basic salary is a predetermined cash amount without any further benefits. The amounts paid to the executive directors is set out in note 28.4 of the annual financial statements. The basic salary is reviewed annually based on the company’s performance in the previous financial year, individual performance, inflation, affordability and market surveys. Increases in the basic salary are effective from the commencement of the financial year once approved by the remuneration committee.

Benchmarking exercises are conducted to analyse whether the basic salary and remuneration mix is market related and competitive. As mentioned earlier, PwC benchmarked executive director remuneration in 2018. Their report was considered in determining the increase to the basic salary of executive directors.

The remuneration committee has resolved to conduct external benchmarking exercises every three years to ensure that the group’s remuneration policy, compensation packages and pay mix are appropriate within the market in which it operates.

Short-term incentives

The executive directors do not currently participate in any STI. As set out in the chairman’s statement, a focus area for the remuneration committee in the year ahead is to consider introducing an appropriate STI.

Conditional share plan (CSP)

The CSP is an equity-settled long-term incentive plan which will provide employees with the opportunity to be awarded shares in the form a conditional right to acquire shares in Stor-Age. Participants can share in the success of the company and will be incentivised to deliver on the business strategy of Stor-Age over the long-term. This will provide direct alignment between the participants – executive directors and key employees – and shareholders.

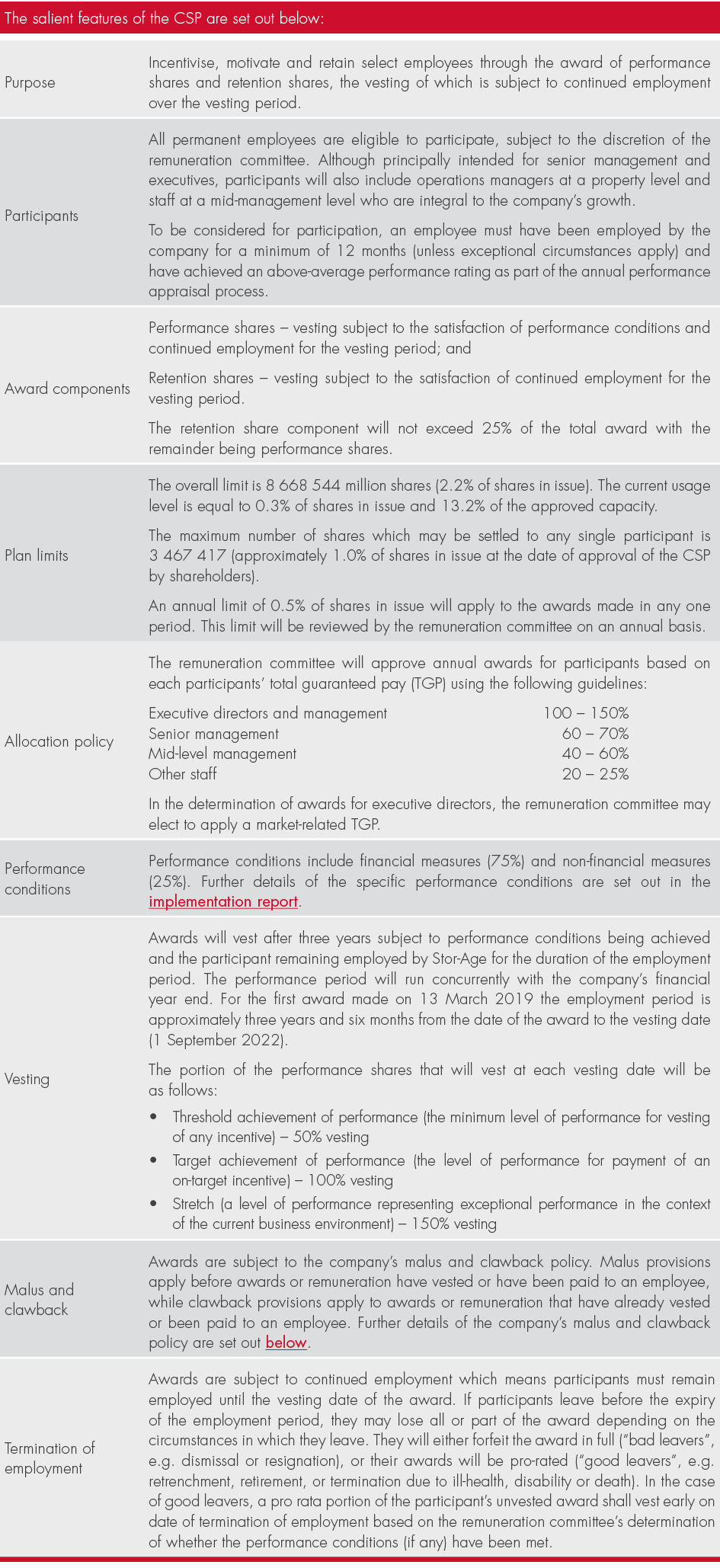

The salient features of the CSP are set out below:

Share purchase and option scheme

Stor-Age introduced a share purchase and option scheme (“share purchase scheme”) on listing. This serves as a mechanism to achieve direct ownership of Stor-Age shares by the executive directors and selected employees, thereby aligning their interests with that of shareholders. Selected individuals are offered the opportunity to acquire Stor-Age shares on market-related terms by way of an interest-bearing loan, subject to certain performance and eligibility requirements. No awards under the share purchase scheme have been made to general staff since September 2017 with participation restricted to the executive directors and a select group of senior managers considered integral to the company’s longterm success. Although the share purchase scheme provides for the grant of options, no options have been granted to date. Non-executive directors are not eligible to participate in the share purchase scheme.

The share purchase scheme is essentially a “management buy-in” plan and exposes participants to real financial risk of share price growth and the repayment of the full loan for the purchase of the shares. This includes instances where the share price decreases from purchase date.

ALL EMPLOYEE REMUNERATION

All employees receive a basic salary at a level appropriate for their role and responsibilities. Stor-Age regularly reviews the basic salary of all employees to ensure it remains market related. Employee salaries (excluding directors) for South Africa and UK staff are reviewed annually in September and in March respectively, taking account of individual and overall company performance, as well as an employee’s experience, qualifications and responsibilities.

Store-based operations employees are paid commission in addition to their basic salaries. This is based on performance relative to the store’s financial budget and achieving pre-defined targets. Other permanent employees (excluding executive directors) receive a component of variable remuneration dependent on their respective employment grade and individual performance.

FAIR AND RESPONSIBLE REMUNERATION

Stor-Age is committed to fair and responsible pay practices in line with its duty to remain a responsible corporate citizen. Various factors are taken into account when considering fair and responsible pay practices, such as sustainability and Stor-Age’s strategic objectives.

Internal pay levels are reviewed on an ongoing basis to ensure alignment with the principle of equal pay for work of equal value. Furthermore, the remuneration committee is mandated to ensure that executive director remuneration is justifiable against remuneration levels of employees throughout the company.

SERVICE AGREEMENTS, RETENTION STRATEGY AND TERMINATION ARRANGEMENTS

The executive directors are permanent employees and their employment contracts include a two-month notice period, with no restraints of trade. There are no contractual obligations to the executive directors in respect of separation or termination payments.

MALUS AND CLAWBACK POLICY

During the year the remuneration committee adopted a remuneration malus and clawback policy, approved by the board, with a view to aligning shareholder interests and remuneration outcomes. It allows the company to reduce or recoup remuneration or awards in defined circumstances such as financial misstatement, gross negligence, misconduct or fraud.

Malus provisions apply before awards or remuneration have vested or have been paid to an employee, while clawback provisions apply to awards or remuneration that have already vested or been paid to an employee. The clawback period will run for three years from the vesting date of the awards.

The policy sets out the circumstances where the board, following the advice of the remuneration committee, may:

- Apply its discretion to adjust the value of an unvested award downwards (to zero if required) or cancel unvested awards; or

- Pursue remedies to clawback any awards or remuneration that have already vested or been paid

to ensure that remuneration outcomes are fair, appropriate and reflect business performance.

All participants who accepted CSP awards during the year agreed to be bound by the malus and clawback policy and further agreed that all remuneration received from the company will be subject to this policy. During the shareholder engagement process prior to the approval of the CSP, it was recommended that the CSP rules be amended to record that awards be subject to malus and clawback provisions. An amendment to the rules has been proposed for the 2019 AGM.

NON-EXECUTIVE DIRECTORS’ REMUNERATION

Non-executive directors do not hold contracts of employment with Stor-Age and do not participate in any short-term or long-term incentives. Remuneration for non-executive directors comprises an annual retainer. Disbursements for reasonable travel and subsistence expenses are reimbursed to non-executive directors in line with the reimbursement policy for employees.

Remuneration for non-executive directors is reviewed on an annual basis considering the responsibilities borne by non-executive directors, as well as relevant external market data. Fees are benchmarked against a peer group of JSE-listed companies in the REIT sector. The remuneration committee recommends the non-executive directors’ remuneration structure to the board for approval. This remuneration structure is further recommended to shareholders for approval at the AGM.

The remuneration to be paid to the non-executive directors for the year ending 31 March 2020 was approved at the AGM held on 23 August 2018 and is set out below. The proposed remuneration for the year ending 31 March 2021, contained within the notice of the AGM, is also set out below:

The proposed increases to non-executive director remuneration are considered against the average increase levels approved across Stor-Age, as well as against the results of benchmarking performed.

Part three

THE IMPLEMENTATION REPORT

This implementation report is subject to an advisory vote by shareholders at the AGM to be held on 22 August 2019.

BASIC SALARY

Executive director salaries are reviewed annually. For the year ending 31 March 2019, the remuneration committee approved an increase of 17.5% for executive directors.

Since listing in 2015, Stor-Age has provided executive directors with a very low basic salary and no STI. No salary increases were accepted by the executive directors in 2016 and 2017. In 2018, a nominal 6.0% salary increase was approved by the remuneration committee. As founders of the business, the remuneration philosophy reflected the executive directors’ commitment to its longterm success and, to a large extent, their desire to prove the sustainability of the business model in the initial years post the listing. The executive directors have continued to execute Stor-Age’s growth strategy with considerable success and have overseen significant organic and acquisitive growth over the last three years.

The remuneration committee recognises the importance of ensuring that executive remuneration is fair, competitive and market related. Based on the external benchmarking report prepared by PwC in June 2018, and taking account of more up-to-date disclosures relating to peer group companies included in the benchmark, the remuneration committee is of the view that executive remuneration is below market. The remuneration committee has resolved to address this over the next two financial years.

In light of this, and considering the performance of the executive directors over the past year, the remuneration committee approved an increase in the basic salary for each executive director from R1.5 million p.a. in the 2019 financial year to R2.0 million p.a. in the 2020 financial year.

The remuneration committee approved an average basic salary increase of 7.4% for other employees in South Africa on 30 September 2018, and an increase of 3.0% for UK employees. In South Africa, the lowest band of employees by pay grade received a 10.0% increase.

In line with Stor-Age’s commitment to fair and responsible remuneration, the remuneration committee carefully considered the increase in remuneration levels of executive directors against the increase for other levels throughout the company and they are satisfied that it is in line with Stor-Age’s policy.

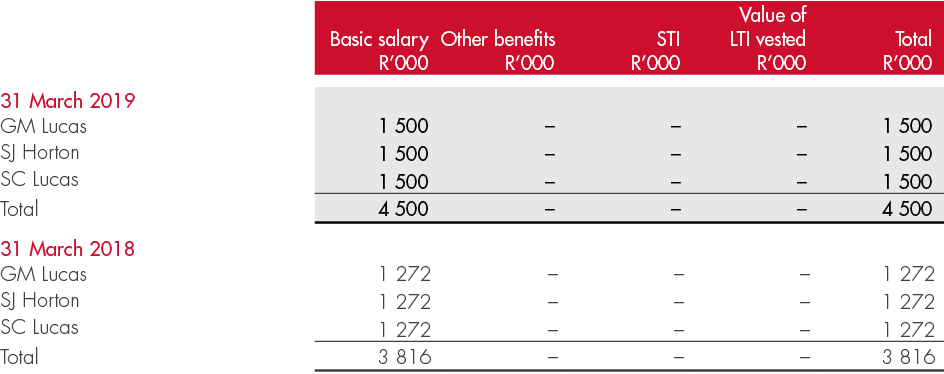

EXECUTIVE DIRECTORS’ REMUNERATION

In line with the requirements of King IV and the JSE Listings Requirements, the table below sets out the total remuneration on a single-figure basis received by executive directors in 2018 and 2019:

Note

While it is recommended practice to insert a

pay mix chart showing the allocation of total guaranteed package and

short-term and long-term

incentives, we have chosen to exclude this as total remuneration comprises

salary only, as evident in the table above.

No additional benefits were paid to executive directors. Stor-Age does not have a STI in place for executive directors. No other remuneration or benefits were paid to executives during the year. No LTI awards vested during the year. Details of CSP award made during the year are set out below.

LONG-TERM INCENTIVE (LTI)

LTIs awarded during the 2019 financial year

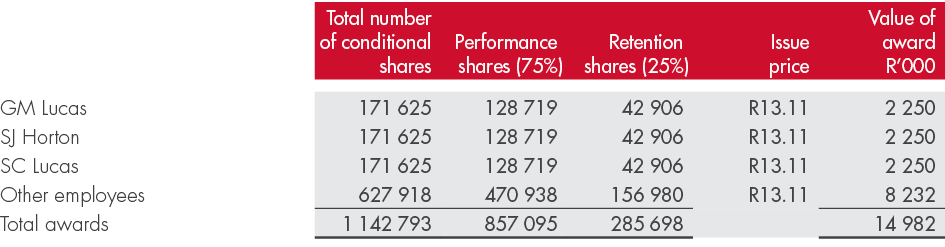

The first tranche of awards under the CSP were made on 13 March 2019. No shares vested during the 2019 financial year.

Details of the awards made on 13 March 2019 are set out below:

The executive directors and remuneration committee support broad based equity participation by employees in the company. In addition to the executive directors, a further 38 employees received CSP awards.

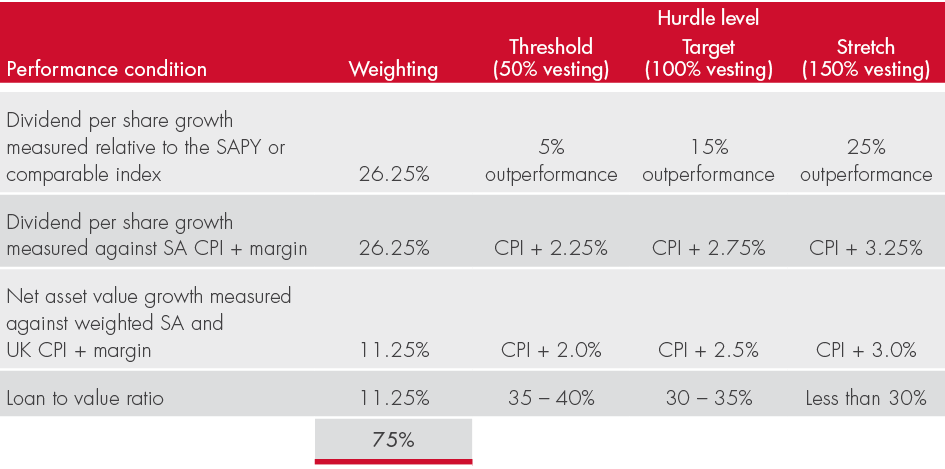

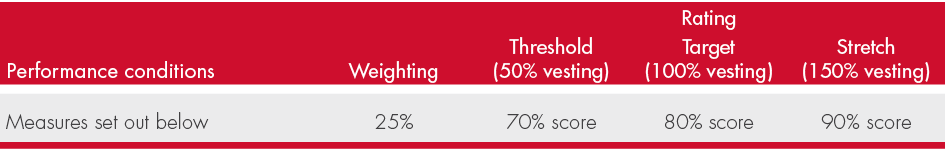

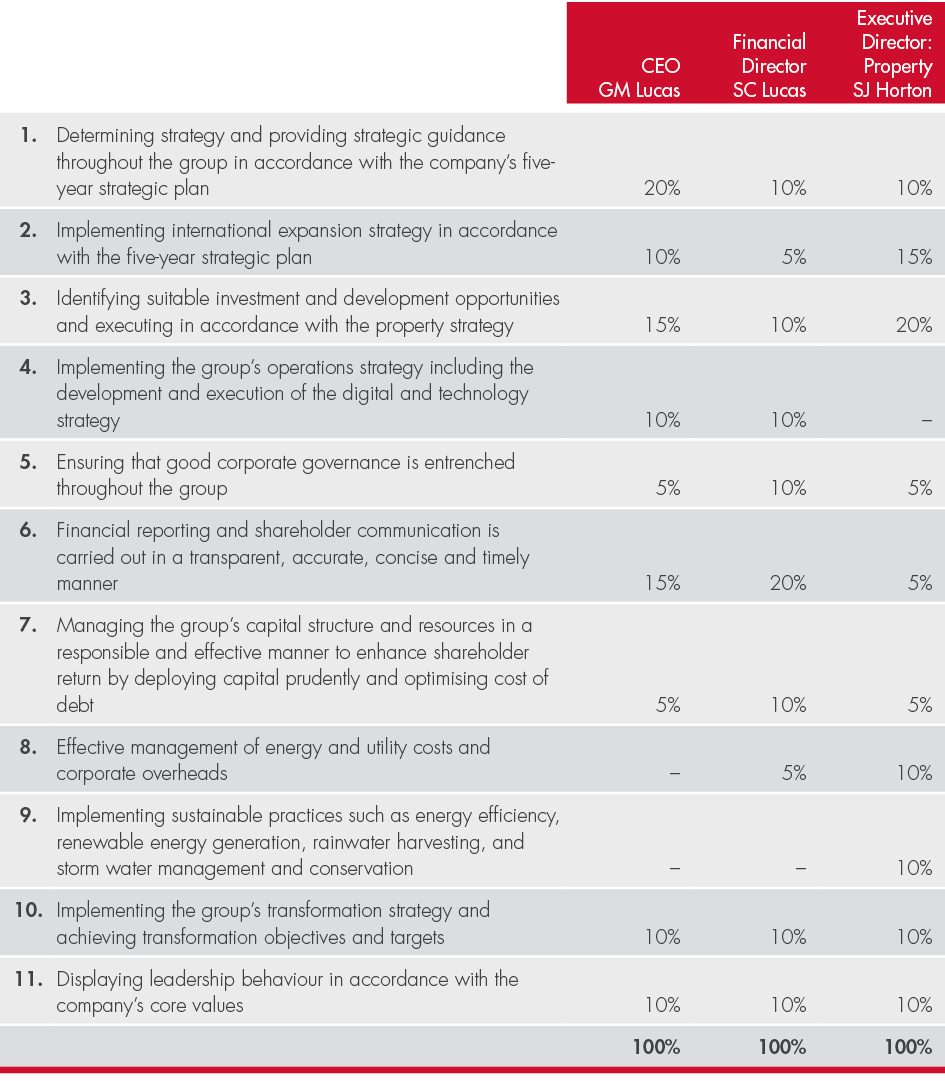

The award comprises performance shares (75%) and retention shares (25%). The performance conditions relating to the performance shares comprises financial measures (75%) and non-financial measures (25%), as set out below, and are subject to continued employment until the vesting date. The retention shares are subject only to continued employment until the vesting date.

The CSP awards made in the 2019 financial year are to be tested over a three year period commencing on 1 April 2019 and ending on 31 March 2022. The awards vest on 1 September 2022. At the end of the performance period, the remuneration committee assesses the performance and adjusts the number of shares awarded to each participant based on the results thereof.

Performance conditions

Financial measures (75%)

Notes

| 1 | SAPY refers to The South African Listed Property index and comprises the top 20 liquid companies, by full market capitalisation, in the Real Estate Investment Trust sector with a primary listing on the Johannesburg Stock Exchange, excluding companies in the Resilient stable. |

| 2 | For each tranche of awards made, the remuneration committee will be responsible for determining an appropriate margin relative to CPI taking account of prevailing market conditions, independent forecasts and external advice where necessary. |

| 3 | In the determination of net asset value, the remuneration committee has elected to use tangible net asset value as the most appropriate metric. |

The financial performance conditions set out above apply to all participants except for operations staff at a property level (approximately 15% of total CSP award) which will be a combination of the above dividend per share measures (30%) and revenue performance targets (70%) specific to the property, or properties as the case may be, managed. This will ensure that the performance conditions are more relevant and specific to their roles.

Non-financial measures (25%)

The following performance measures will apply to the determination of the non-financial measures score for the executive directors:

For other participants, scores will be determined by reference to their individual Key Performance Areas (KPAs) which are set and agreed upon annually for each employee as part of the annual performance appraisal process. The company uses a “1–10” rating scale for each employee KPA and then an overall rating for the employee’s performance. The following ratings will apply:

- Overall rating of 6: Employee achieved the required standards (threshold)

- Overall rating of 7–8: Employee exceeded the required standards (on-target)

- Overall rating of 9–10: Employee achieved exceptional performance (stretch)

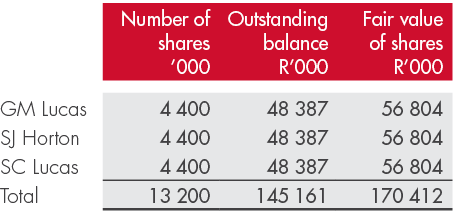

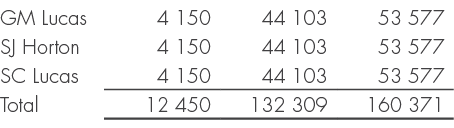

DIRECTORS’ INTERESTS IN SHARES ACQUIRED IN TERMS OF THE SHARE PURCHASE AND OPTION SCHEME

Selected participants of the share purchase scheme are offered the opportunity to purchase Stor-Age shares by way of an interest-bearing loan from the company to build up a shareholding and share in the long-term success of Stor-Age. The remuneration committee approves the offer to participants to purchase shares under the scheme.

Although the acquisition of shares in this manner is not considered to be remuneration, it does impact the executive directors’ shareholding in Stor-Age and ensures alignment with shareholders. We have therefore chosen to include these details in the remuneration report.

During the year 1 130 000 shares were issued to participants under the share purchase scheme. Further details are set out in note 4 of the annual financial statements. At 31 March 2019, 16 719 440 shares had been issued under the share purchase scheme. This represents 4.25% of shares in issue.

The table below provides details of the current shareholding, outstanding loan and the fair value of the shares relating to the executive directors under the share purchase scheme.

31 March 2019

31 March 2018

Further details relating to the share purchase scheme and the shareholding of the executive directors are set out in note 4 and 28.3 of the annual financial statements respectively.

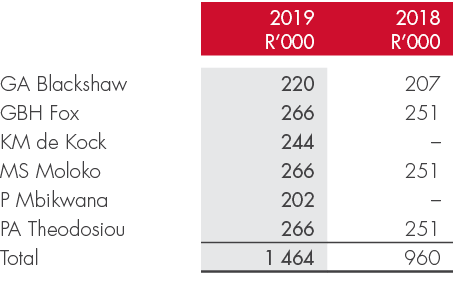

NON-EXECUTIVE DIRECTORS’ REMUNERATION

The table below sets out the remuneration paid to non-executive directors:

The remuneration to be paid to the non-executive directors for the year ending 31 March 2020 (approved at the AGM held on 23 August 2018), as well as the proposed remuneration for the year ending 31 March 2021 (to be approved by shareholders at the forthcoming AGM), is set out in the table here.

This report was approved by the remuneration committee and the board. Both are satisfied that there were no material deviations from the existing remuneration policy during the 2019 financial year.