Stor-Age at our core – put simply, Stor-Age exists because we solve people’s and businesses’ space problems.

Our primary objective is to actualise within a number of dimensions simultaneously for maximum value creation. Stor-Age aims for purpose and profit; continuity and change; freedom to innovate; and responsibility. We strive to respect our colleagues, our customers, ourselves and the organisation, which is greater than the sum of its parts.

Our four core values guide and inspire every single thought, action and decision: Excellence, Sustainability, Relevance and Integrity. Read more about how our core values drive our thinking in the case study.

What we do

Our portfolio comprises 65 self storage properties across South Africa and the UK, with a combined value of over R6.0 billion.

Stor-Age rents space to the public, both individuals and businesses, on a short-term flexible lease basis. Across our portfolio of 65 properties, we manage more than 32 000 individual leases. In South Africa, we experience a churn rate of approximately 5.0% per month and benefit from more than 1 400 new tenants moving in on average every month. In the UK, we experience a churn rate of approximately 8% per month and benefit from more than 600 new tenants moving in on average every month.

Our average unit size in the UK (6.8 m2) is considerably smaller than our average size in South Africa (12.5 m2). The smaller average unit size in the UK contributes directly to the higher churn rate of 8%.

Developing and acquiring properties

Acquisition capability

Our leading corporate platform, skilled operational management team, industry relationships, and specialist sector experience ensure that Stor-Age is well-positioned to identify and capitalise on strategic acquisition and development opportunities with attractive growth potential. This is evidenced by our successful acquisition and development track record since listing.

Our ability to close transactions and integrate trading stores seamlessly onto our operating platform has also been consistently demonstrated. Since the start of 2017, we successfully completed eight transactions to complement our ongoing success in the South African and UK markets. This includes significant multiproperty transactions, two of these being the offshore acquisition of Storage King in November 2017 and the acquisition of the Managed Portfolio in South Africa in October 2018.

We continue to improve our operating platform and infrastructure to maximise revenue, reduce costs and ultimately deliver enhanced returns. At a property level, our people and the high-quality, secure and convenient space offered by our portfolio attract and retain a diverse customer base.

Developments

Stor-Age develops investment-grade self storage properties in visible, convenient and accessible locations where there are favourable demographics and where suitable acquisitions are not available. The decision is based on the cost of development versus the cost of acquisition, the demographic market analysis and the existence of barriers to entry. Our model for rolling out new properties and expanding existing ones is well-developed with clearly defined key success criteria.

During the year, we opened a high-profile Big Box property in Bryanston that will offer 6 100 m² GLA on full fit-out and we commenced construction of a new property in Craighall. Both properties have been developed using the Certificate of Practical Completion (CPC) model. On completion of Craighall (expected in August 2019), the properties will offer an estimated combined 12 750 m² GLA on full fit-out.

Read more about the CPC model in the CEO’s report.

ENERGY GENERATION CAPABILITY

45 of our 49 properties in South Africa are fitted with generators. In the event of an outage, power is seamlessly generated to support the following systems at our stores:

- on-site operating system and server;

- telephone lines and internet connectivity;

- access control and security system;

- electric fence and perimeter beams;

- fire system;

- emergency lighting; and

- the lifts and hoists.

Generation capacity of up to 110 kilo-volt-ampere per property allows us to continue operations without major disruption during load shedding or supply cuts.

Generators will be installed at the remaining four properties during the 2020 financial year.

Barriers to entry and the defensive nature of our portfolio

The barriers to new supply in key target nodes are significant. The industry was historically positioned in industrial or urban-edge areas. As a result, there are limited premium-grade self storage assets in prime urban and suburban nodes, where population density and average household income are key.

Town planning presents a major challenge with long lead times required to gain planning consents. This, in addition to the long lease-up period (financing cost implications) required to reach stabilised occupancy at new stores, is a significant barrier to entry and contributes to the defensive nature of our portfolio.

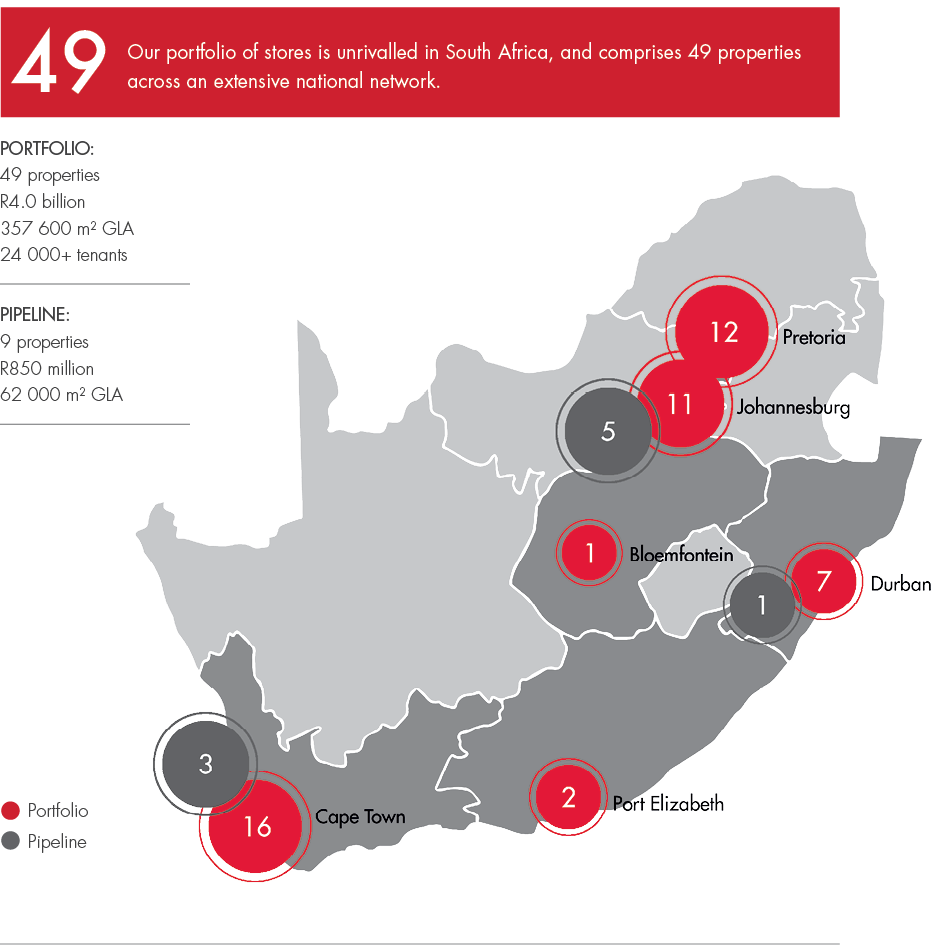

Our property portfolio in South Africa

Our South African portfolio is predominantly purpose-built with a national footprint. The 58 properties comprise 49 trading properties and nine new developments in our pipeline. Our 49 trading properties will offer an estimated 363 000 m² GLA once fully fitted out. Our pipeline of nine new properties offers further GLA of 62 000 m² on full build-out.

In defining our property strategy in South Africa, we identified the four main cities on which to focus and then the specific suburbs (including arterial routes) where we would like to establish a presence. This is not a restrictive or instructive strategy, rather a guide that supports our full business growth strategy.

Maintaining our properties

As a customer-facing real estate business, it is paramount to maintain the quality of our assets by investing in a rolling programme of preventative maintenance, store cleaning and the repair and replacement of essential equipment.

We have a bespoke, online-based Facilities Management System for store-based employees to log, track and manage all maintenance requests until closed. In conjunction with our store-based employees and area managers, our national facilities manager and city-based regional facilities managers oversee property maintenance with the assistance of dedicated teams in each city.