Big Box self storage properties

Our properties are developed in prime locations across South Africa. Light, bright, safe and secure, our Big Box properties are modern, purpose-built and multistorey.

As the leading developer of these properties in the South African market, we capitalise on market requirements more efficiently than our competitors.

Chairman’s letter

At the time of our listing in November 2015, Stor-Age aimed to deliver attractive and sustainable shareholder returns by bringing to market a highly specialised self storage REIT. Today, Stor-Age is a recognised and dynamic industry specialist with an ambition to outperform the sector and our own benchmarks, and I am pleased to report that we continue to successfully deliver on our objectives. This is evidenced by an excellent fourth set of financial results, driven by strong organic growth in our South African and UK portfolios and the successful integration of acquisitions.

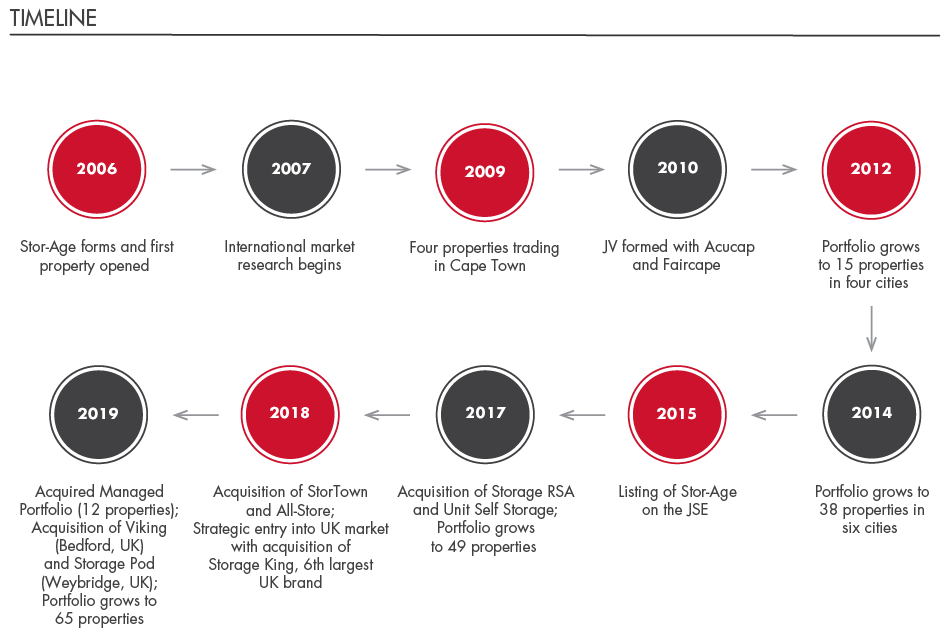

A track record of delivery

Since listing, Stor-Age has executed its strategy with considerable success and created ongoing value for shareholders in a difficult operating environment. This is evidenced by our track record of acquiring, developing, leasing and operating self storage assets.

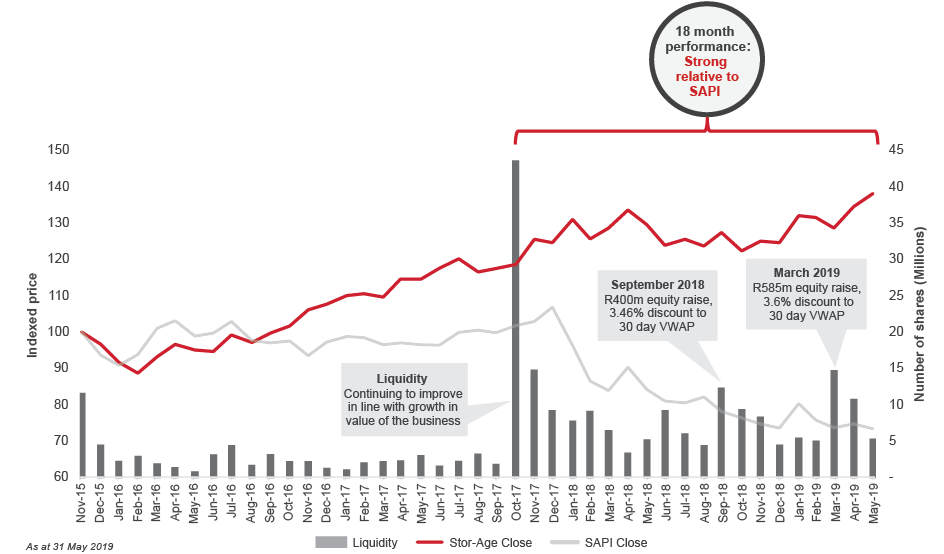

The group continues to deliver sustainable growth in returns through real gains in rental rates and occupancies. The value of our portfolio has increased from R3.9 billion to R6.0 billion, our market capitalisation has grown to R5.4 billion as at 31 March 2019 and the number of properties in the REIT increased from 50 in 2018 to 65.

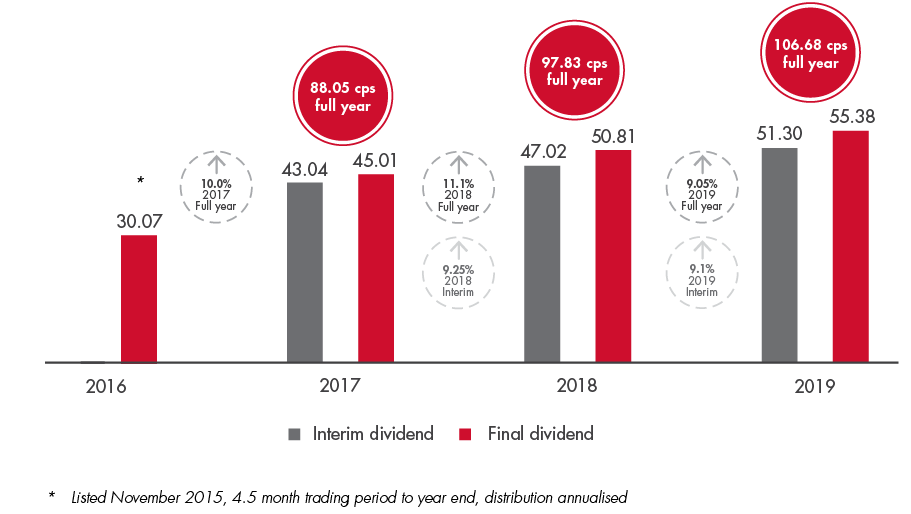

Stor-Age is the market leader in South Africa and one of only 101 publicly traded self storage REITs globally. Since listing, our shareholders have enjoyed increasing earnings and attractive dividend growth, supported by consistent increases in net asset value (NAV).

| 1 | Shurgard Self Storage, listed on Euronext Brussels, is not a REIT, but included in universe. |

Distribution per share (CENTS PER SHARE)

Share PRICE PERFORMANCE RELATIVE TO South Africa LISTED PROPERTY INDEX (SAPI)

Stor-Age’s ability to strategically identify and execute investment opportunities and integrate acquisitions remains a competitive advantage.

In South Africa, the acquisitions of All-Store and the Managed Portfolio have positioned us well in a low-growth macroenvironment. The addition of Viking Self Storage and The Storage Pod demonstrates our ability to source, fund and conclude high-quality acquisitions in the UK market. These acquisitions are further evidence of our ability to scale our business in a manner that satisfies our investment criteria. Read more about these acquisitions in the CEO’s report.

Operationally, we executed our Storage King integration plan in line with our strategy. Our proven experience in closing and integrating transactions, treasury management and capital allocation is yielding positive results. We believe the UK business is now well-positioned to pursue its medium-term goal of 85% occupancy, as well as to capitalise on future growth opportunities in a disciplined manner.

Two oversubscribed bookbuilds, one in September 2018 and another in March 2019, successfully raised R985 million in equity. This enabled us to acquire existing trading properties in the UK, fund new development sites in South Africa and strengthen our overall balance sheet. The strong demand evidenced in the two bookbuilds and improved liquidity is testament to the high regard in which Stor-Age is held and reflects investor support for our growth strategy.

Our strategy to counter South Africa’s constrained local economy centred on maintaining a strong balance sheet, growing our exposure in the UK market and remaining true sector specialists by only acquiring and developing self storage assets of the highest quality.

Looking forward, we intend to play our part in South Africa’s economic turnaround by growing our portfolio, creating employment opportunities and unlocking shareholder value.

In addition, we would like to see positive change in the management of our state-owned enterprises and our economy more broadly, ultimately translating into improved GDP growth in the medium term.

Our proven experience in closing and integrating transactions, treasury management and capital allocation is yielding positive results.

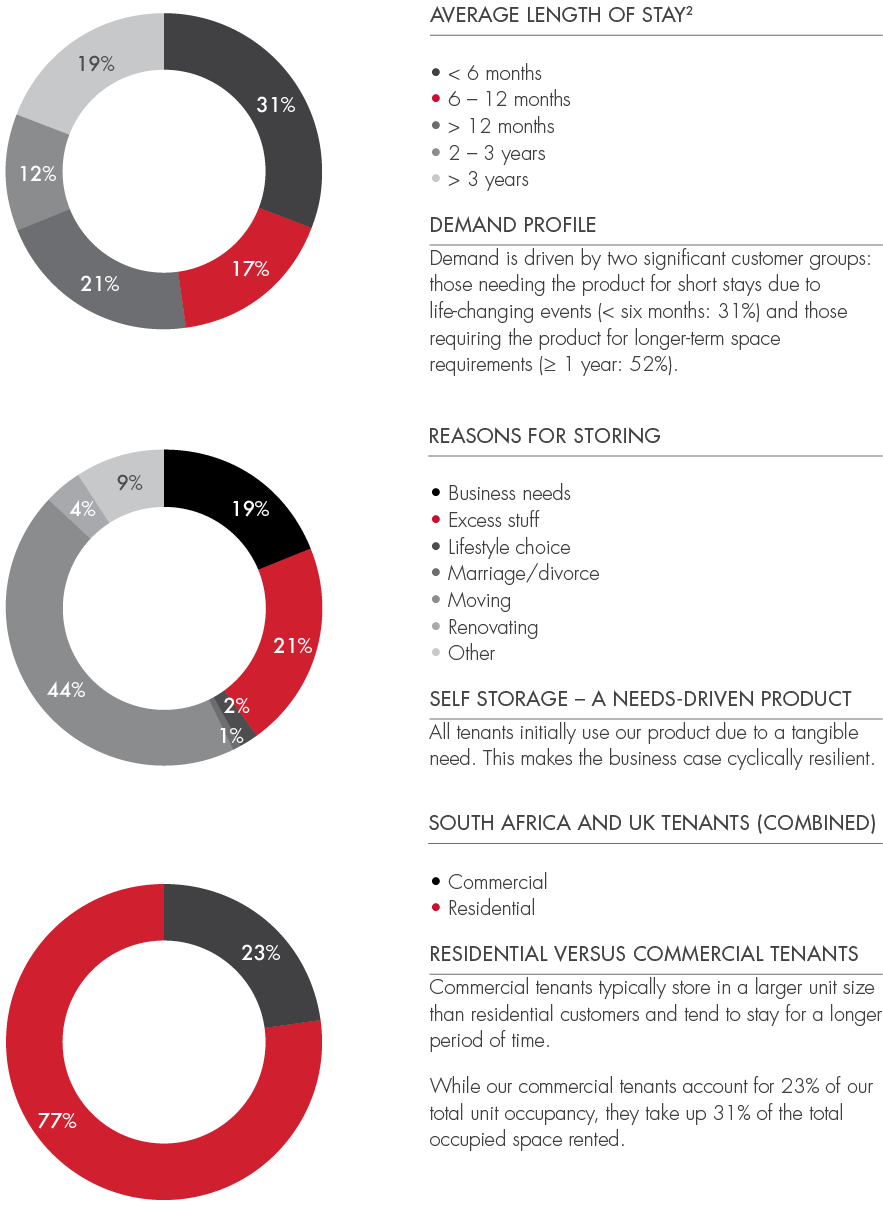

Creating value and Meeting demand

Demand from individuals and businesses across our South African and UK property portfolios is directly influenced by local economic activity and consumer and business confidence, all of which are interrelated. However, self storage remains needs-driven and an asset class with highly defensive characteristics. In addition, the flexibility of the product makes Stor-Age’s business case cyclically resilient.

Globally, demand for space is created by population growth, an emerging middle class, urban migration, flexible living choices and property downsizing. Individuals and businesses, particularly start-ups and small, medium and micro enterprises (SMMEs), require adaptable storage options.

Self storage industry trends

South Africa

We continue to see the establishment of new self storage properties. Many of these are opened in less-than-desirable locations and where barriers to entry are typically quite low. Where properties are opened in improved locations, they are typically pre-existing buildings that have been converted into self storage assets or where a self storage operator has taken a short-term lease from a landlord. The short timeframe underlying this type of lease, as well as the relatively high cost to fit out a self storage building, often results in limited capital investment by operators and a less desirable product for customers.

| 2 | For South Africa only |

While sector dynamics vary significantly across the four main centres in which we trade (Cape Town, Johannesburg, Tshwane and Durban), the South African self storage industry is fast-growing and remains an attractive sector in terms of economic returns.

Albeit limited, we continue to see the establishment of good quality self storage properties in key locations across the country, as well as the reinvestment of self storage industry capital into the market by previous vendors. This presents opportunities for us to leverage our scale and consolidate new properties that can supplement our pipeline of local development opportunities.

In specific nodes, we are seeing saturation of supply relative to demand. This differs within each of our four main cities. Accordingly, Stor-Age will only develop new properties where the barriers to entry are at their highest – most often targeting prime real estate. This approach almost always requires the business to undertake a full rezoning or town planning process, which can take up to three years or longer.

From an acquisition perspective, we remain highly selective and decline opportunities if we are not fully satisfied that the underlying real estate fundamentals warrant capital investment. We also ensure sufficient demand relative to existing supply before we invest.

The global self storage market

The self storage sector has historically outperformed the property sector and remains a growth sector globally, with a long track record in first-world markets.

This is evidenced by all self storage REITs in the US and Europe (including the UK) trading at premiums to NAV.3 In the US, this has recently ranged up to approximately 20%. In Europe, all three self storage REITs were trading at premiums to NAV above 40% at the end of March 2019.

| 3 | UBS self storage sector overview, March 2019. |

In terms of supply, the US now boasts over 54 000 self storage properties, Europe (excluding the UK) more than 2 200, the UK more than 1 500 and Australia more than 1 300.4

| 4 | The Self Storage Association UK annual industry report, 2019. |

Despite more elevated supply levels in the US in recent times, underlying demand for storage space and pricing power remained strong. European self storage REITs generally outperformed the broader European real estate market and European equities, performing particularly well up to the end of March 2019.

As can be seen by the graph below, UK self storage REITs have significantly outperformed all other UK REITs over the last five years:

Our UK properties now constitute nearly a third of our total portfolio by value. Brexit-related uncertainty is likely to continue affecting business and consumer sentiment, which may negatively affect the UK economy. If the UK successfully withdraws from the EU, Oxford Economics anticipates that the country’s economic prospects will remain positive for the rest of the calendar year, with economic activity expected to pick up and reach 1.7%. In the case of a no deal, GDP is expected to fall to 1.0% in 2019 and 0.8% in 2020 before gradually recovering. Ultimately, this uncertainty will persist until the UK’s trading relationship with the EU is more clearly defined.

Despite this uncertainty, the UK self storage sector continues to prove resilient and demand is growing faster than supply. Approximately 1.7 million square feet of space was added during the year, and occupancy levels and industry profits continue to increase. Our Storage King portfolio has also performed in line with our expectations since the acquisition in November 2017.

As before, we will continue to vigilantly monitor the UK operating environment. However, I remain confident that Stor-Age is well-prepared for any shifts that could negatively impact growth.

The self storage sector has historically outperformed the property sector and remains a growth sector globally, with a long track record in first-world markets. This is evidenced by all self storage REITs in the US and Europe (including the UK) trading at premiums to NAV.

Performance backed by solid governance

Stor-Age is a relatively young business that is continuing to grow and evolve. Our decisions are guided by our four core values of Excellence, Sustainability, Relevance and Integrity.

In line with our core values, the board and executive team promote ethical business conduct and corporate governance as critical components of Stor-Age’s sustainability and success over the medium to long term. In this regard, I particularly value the contribution made by our diverse and experienced board.

As noted in my letter last year, the board undertook a detailed self-evaluation to identify improvement opportunities. During the period under review, we implemented several initiatives to strengthen our governance structures:

- We engaged with key shareholders through our remuneration committee to successfully update our remuneration policy and framework and introduce a long-term incentive scheme in the form of a Conditional Share Plan (“CSP”). All permanent employees are eligible to participate in the CSP, including senior managers and executives, operations managers at the property level and mid-management employees.

- We engaged with external advisors to structure and execute the buy-out of the entire Managed Portfolio and eliminate executive management’s former related-party relationships in respect thereof.

- To improve our board’s understanding of the UK self storage market and reduce overall risk exposure, members of our investment committee conducted a tour of a significant number of self storage properties in the broader London market in August 2018. Site visits included properties in the Storage King portfolio as well as properties of leading industry peers.

I am proud to announce that following a review of the FTSE/JSE Africa Index Series, Stor-Age was included in several indices in March 2019. Companies included in this index make up the top 99% of the total pre-free-float market capitalisation of all listed companies on the Johannesburg Stock Exchange. Inclusion in these indices for the first time represents another milestone for Stor-Age on its growth journey and is testament to the ongoing and disciplined execution of its growth strategy.

We are making good progress towards compliance with the recently amended Property Sector Codes, which supports transformation within the property sector. The group’s approach is based on our three-year Transformation Plan, launched in 2018. Our philosophy is to drive empowerment from within the group, and along with our advisors, we are currently exploring the potential creation of an education trust and share ownership scheme for previously disadvantaged employees. Read more about this plan in our corporate governance report.

Regarding international growth, we have established a well-defined medium-term strategy and a clear framework of authority to guide decision-making for our UK business. With the benefit of hindsight, the strength of this strategy and framework was evidenced through our investment activities in the current year. These activities required strict adherence to a well-defined process, including meeting key financial hurdles when considering any new acquisition opportunity. As a result of these strict investment criteria, the group chose not to proceed with several potential transactions during the year.

Outlook and thanks

Stor-Age’s business model is based on global best practice and established networks with leading first-world market peers. We deliver unmatched value and service to our customers, locally and in the UK. This is supported by a leading-edge operational platform and a skilled digital marketing capability. Stor-Age also benefits from a welldefined strategy and clear vision and mission, which are deeply embedded across all levels of the business.

As a result of these strengths, Stor-Age remains well-placed to capitalise on opportunities across the self storage industry and deliver attractive, risk-adjusted growth in distributions and underlying portfolio value.

These successes could not be achieved without the single-minded focus, ongoing support and guidance of our board and the relentless pursuit of excellence by our highly capable Stor-Age team. This includes the executives, senior management and a valued group of employees across the organisation.

Once again, congratulations to the management team and all employees on a successful year. Thank you for your continued energy, commitment, expertise and the passion with which you carry Stor-Age forward for the benefit of all stakeholders.

Paul Theodosiou

Chairman

11 June 2019