Corporate governance

Stor-Age is committed to sound ethical standards and the principles of good corporate governance.

The board is ultimately responsible for guiding our strategy and for approving policies and practices that ensure we conduct business according to the company’s Core Values of Excellence, Sustainability, Relevance and Integrity. It does this within an appropriate framework of governance and oversight to ensure stakeholder interests are safeguarded.

Board focus areas for the past financial year

| Board focus areas | Actions undertaken by the board |

| Transformation | The board invested resources to better understand the newly legislated Property Sector Code, and subsequently developed a three-year Transformation Plan to guide its transformation objectives. The board appointed a transformation committee that comprises senior and middle management to oversee implementation of the plan. |

| Diversity | The board ran a recruitment process to appoint two new female members to the board. |

| International expansion | The board appointed Investec Corporate Finance to advise on the group’s move into the UK market. |

| Disciplined execution of the five year strategy to 2020 | The board oversaw the continued execution of the group’s property growth strategy. This includes researching and formatting a medium-term property growth strategy for the UK market as well as initiating discussions with the senior management team to begin formulating its thinking towards 2025. |

From King III to King IV™

We implemented King IV™ after thorough consideration of the recommended practices. As a relatively young and growing business, we endeavour to evolve our corporate governance practices, policies and procedures in tandem with our business, taking guidance from the recommended practices outlined in King IV™.

Our application of King IV™ is set out in a separate document available on our website. This document provides high-level references to our disclosures per principle (including non-compliance, where relevant).

Overall, the board is satisfied with the application of the principles and believes that it effectively discharges its responsibilities to achieve the good governance outcomes of an ethical culture, good performance, effective control and legitimacy with stakeholders.

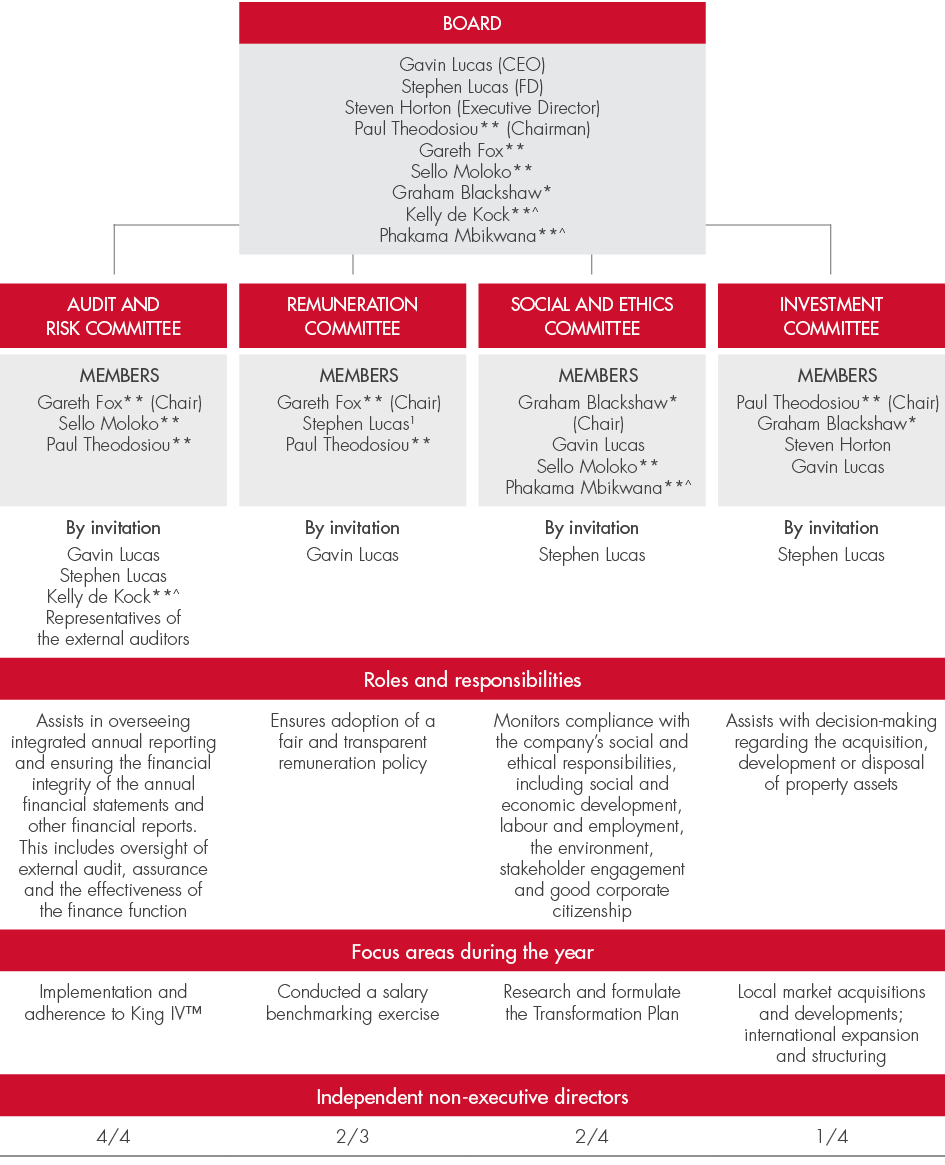

Governance structure

The board is ultimately fully responsible for the strategic direction, control and management of the company and is satisfied that it has fulfilled its responsibilities according to its charter for the year. To assist it in fulfilling these responsibilities, the board has appointed subcommittees.

For more information on the qualifications and experience of subcommittee members, refer below.

The board exercises control through a governance framework. This includes reviewing detailed reports presented to it and its subcommittees, and oversight of our continuously updated risk management programme to ensure effective management and control of the risks facing the business. The board and subcommittee structure is supported by appropriate internal governance practices and procedures. These promote an efficient, objective and independent decision-making culture that considers the interests of all stakeholders.

The terms of reference of the board and its subcommittees deal with such matters as corporate governance, compliance, directors’ dealings in securities, declarations of conflicts of interest, board meeting documentation, and procedures for the nomination, appointment, induction, training and evaluation of directors.

At board level there is a clear division of responsibilities and an appropriate balance of power and authority. No individual has unfettered powers of decision-making or dominates the board’s deliberations and decisions. The board regularly reviews the decision-making authority given to management and those matters reserved for decision-making by the board.

The role and responsibilities of the chairman and the CEO are clearly defined and distinct:

- The CEO is responsible and accountable for the overall operations of the group and implementation of the strategy and objectives adopted by the board.

- The CEO’s notice period is two months and there are no contractual conditions related to the CEO’s termination. The CEO has no other professional commitments outside of Stor-Age.

- The independent chairman is responsible for ensuring proper governance of the board and its subcommittees, ensuring that the interests of all stakeholders are protected, and facilitating constructive engagement between the executives and the board. The chairman does not chair any other listed company.

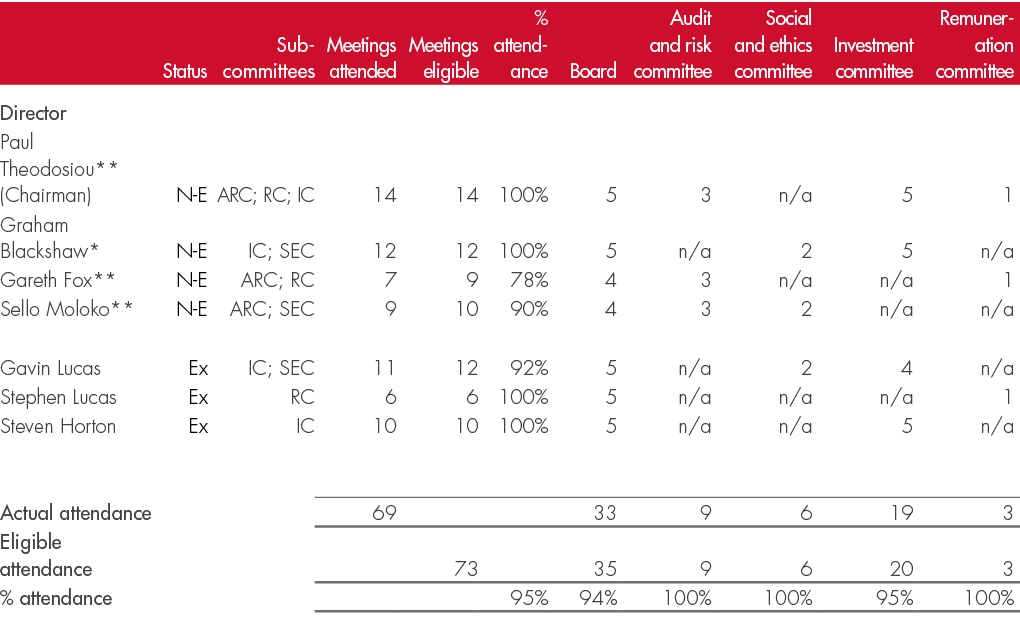

Board and SUBcommittee meetings

The table below sets out the board and committee meetings held during the reporting period and the attendance at each:

| * | Non-executive director |

| ** | Independent non-executive director |

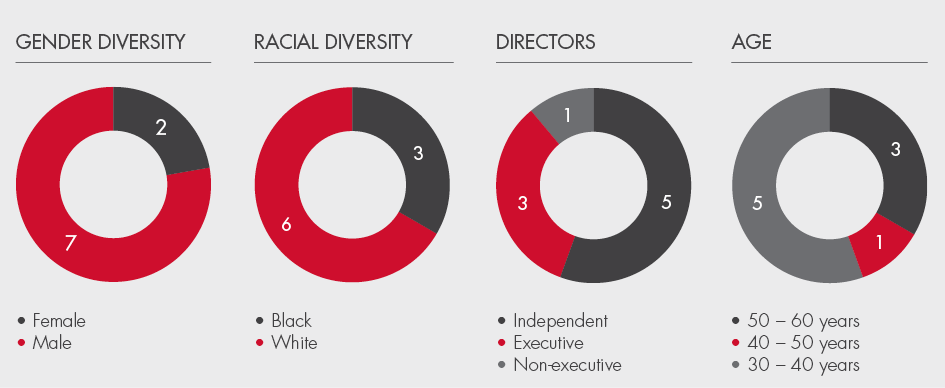

Composition of the board

Board skill set and expertise (number of directors)

To reduce gender- and race-related under-representation by 2021, Stor-Age developed a three-year Transformation Plan. This plan will also assist us to achieve compliance with the recently amended Property Sector Code, and outlines ten key milestones to drive transformation in the business.

A highlight post year end was the appointment of two new black female board members – Phakama Mbikwana and Kelly de Kock. Both joined the board as independent non-executive directors, effective 1 May 2018. Phakama Mbikwana joined the group’s social and ethics committee. Kelly de Kock will join the audit and risk committee and the remuneration committee.

We further strive to increase racial diversification at board level – our Transformation Plan will be critical in assisting us to implement a broad-based strategy to achieve sustainable business transformation.

During the year, Stor-Age appointed an independent third-party, Questco Corporate Advisory, to run a formal recruitment and selection process to facilitate the appointment of the two new board members. There were no other changes to the board during the year.

Directors

Gavin Lucas Chief executive officer (CEO) – CA(SA)

An entrepreneurial property developer backed by an experienced management team of professionals with a range of skills including investment banking, finance, property and construction, Gavin founded the Stor-Age Group in 2005. Leading the organisation by providing a common vision and mission, Gavin is responsible for the strategic direction of the group, coordinating plans to meet strategic goals, overseeing the overall operations, and stakeholder engagement.

Appointed to the board in November 2015.

Stephen Lucas Financial director – CA(SA), CFA

Stephen is one of the founding shareholders of Stor-Age and has worked alongside Gavin and Steven in developing the Stor-Age business since its inception. Stephen focuses on the group’s financial and operational management, human resources and developing and executing the operations strategy. He also has previous advisory experience in corporate finance and transaction support.

Appointed to the board in November 2015.

Steven Horton CA(SA)

Steven is head of property and directs the group’s property growth strategy. He oversees the procurement of all opportunities and the development planning, development and property management of the portfolio. Steven drives Stor-Age’s acquisition and expansion efforts in South Africa and the UK.

Appointed to the board in November 2015.

Graham Blackshaw BA LLB

A former lead development partner in the Faircape group of companies, Graham played an integral role in driving the formation of the Stor-Age joint venture between Acucap, Faircape and Stor-Age Property Holdings in 2010. A qualified attorney, Graham practiced law at Herold Gie and Broadhead before joining the Cape of Good Hope Bank, where he went on to head up the Property Lending Division.

Appointed to the board in November 2015.

Paul Theodosiou Chairman – CA(SA), MBA (UCT)

Partnering with NIB in the promotion and subsequent listing of Acucap Properties Limited on the JSE, Paul successfully led Acucap as CEO for close on 15 years prior to its merger with Growthpoint in 2015.

Appointed to the board in November 2015.

Appointed to the audit

and risk committee in November 2015.

Sello Moloko BSc Hons, PGCE (Leicester), AMP (Wharton)

Sello is the co-founder and executive chairman of Thesele Group and has more than 24 years’ experience in financial services. He is the former non-executive chairman of Alexander Forbes Group Holdings Limited, former CEO of Old Mutual Asset Managers and former deputy CEO of Capital Alliance Asset Managers. He is currently the chairman of Sibanye Gold Limited, and a non-executive director of Telkom and General Reinsurance Africa. He is also a former director of the Industrial Development Corporation and listed companies Gold Fields, Makalani Holdings, Acucap Properties and Sycom Property Fund.

Appointed to the board in November 2015.

Appointed to the audit

and risk committee in November 2015.

Phakama Mbikwana BCom

Phakama graduated from Rhodes University in 2002, after which she completed a Bridging Certificate in the Theory of Accounting at Rand Afrikaans University. She also holds an International Executive Development Programme Certificate from US based Duke Corporate, an affiliate of Duke University. She is the founder and current sole member of Dandelion Capital, a company seeking to invest in diverse sectors in order to drive growth and influence strategy. Until recently, she held the position of Head of Construction and Related Sectors at Barclays Africa, and prior to that she held roles at Standard Bank Group, Investment Solutions, Alexander Forbes Multi Asset Management and Nedbank Corporate.

Kelly de Kock CA(SA), CFA, MBA (UCT)

Kelly is specialised in the areas of corporate finance and investor relations, as well as mergers and acquisitions. She has more than 11 years’ commercial experience in the financial services sector and currently holds the position of Chief Operating Officer at Old Mutual Wealth Trust Company. She previously held the positions of Head of Institutional Business Development at Kagiso Asset Management and Investor Relations Manager: South Africa at Old Mutual plc.

Appointed to the board in May 2018.

Gareth Fox CA(SA)

Gareth is Chief Operating Officer of Western National Insurance Company Limited. He originally completed his articles in financial services at PwC and thereafter headed up the regulatory reporting and tax teams at Santam. He has sat on the South African Insurance Association taxation subcommittee and the Financial Services Board’s SAM discussion group.

Appointed to the board in November 2015.

Appointed to the audit

and risk committee in November 2015.

Board recruitment and training

In line with the board’s appointment process, all new appointees are required to possess the necessary skills to contribute meaningfully to the board’s deliberations and to enhance the board’s composition in accordance with recommendations, legislation, regulations and best practice. An induction programme is provided for new directors by the company’s sponsor.

Directors are also encouraged to take independent advice at the cost of the company for the proper execution of their duties and responsibilities. The board has unrestricted access to the external auditors, professional advisers, the services of the company secretary, the executives and the employees of the company at any given time.

Directors and committee members receive comprehensive information that allows them to properly discharge their responsibilities. The sponsor is responsible for ongoing director development. The board is satisfied that the arrangements for training and accessing professional corporate governance services are effective.

Board rotation

A third of the non-executive directors must resign and stand for re-election at each annual general meeting. Details of directors making themselves available for re-election at the forthcoming annual general meeting.

Board ethics and efficiency

The board conducted a self-evaluation during the year. Read more in the Chairman’s Letter.

The board is satisfied that the self-evaluation conducted during the year improved its performance and the effectiveness of the governing body. To further improve its performance evaluation going forward, the board will reassess its self-evaluation criteria to include ethics and behaviour aligned to Stor-Age’s Core Values of Excellence, Sustainability, Relevance and Integrity.

Company secretary

The board is assisted by a suitably qualified company secretary, Henry Steyn, CA(SA) who has adequate experience, is not a director of the company and who has been empowered to fulfil his duties. The company secretary advises the board on appropriate procedures for managing meetings and ensures the corporate governance framework is maintained.

The directors have unlimited professional access to the company secretary. Nothing has come to the attention of the board that indicates non-compliance by the company with applicable laws and regulations.

Given that the company secretary is not a director or an associate of a director of Stor-Age, the board is satisfied that an arm’s length relationship is maintained between the board and company secretary.

During the year, the board considered the arrangements of the company secretary and confirms it is satisfied that these arrangements are effective. The board is further satisfied that Mr Steyn is suitably qualified and experienced.

IT governance

The business potential of digital technologies and enhanced connectivity is in tension with the greater vulnerability of being connected to a global network such as the internet. We have noted the global increase of ransomware and other cyber security attacks. Subsequently, a number of enhancements were made to our layered network security systems during the year to strengthen defences.

While there were no major incidents during the reporting period, it is no reason for complacency. An independent consultant was appointed to assess the group’s network cyber security measures by attempting to breach its defences. We also chose reputable, specialist service providers as business partners to ensure continued cyber security measures are maintained at the highest level.

We regularly restore daily backups to confirm the validity of the backup and that there was no data corruption. Each location joined to the network has a primary and secondary last mile connection to ensure maximum uptime. Internal and external users are continuously monitored to ensure the most effective use of resources and to limit the opportunity to breach the group’s cyber defences. Our strategy, suppliers and network design are reviewed on a regular basis to stay abreast of leading best practice and remain relevant in the use of technology. External specialists are appointed by the board when considered necessary.

While satisfactory, the board will focus on strengthening its IT policy in the year ahead to further enhance the effectiveness of the group’s technology and information governance.

Approach to compliance

The board recognises its responsibility to ensure compliance with and adherence to all applicable laws and industry charters, codes and standards, as outlined in its charter. When necessary, the board appoints corporate advisers with sector-specific knowledge and insight to assist with managing the group’s compliance requirements. The board is supported by the executive management team, who are considered to be adequately qualified and experienced to provide direction on possible compliance contraventions.

The social and ethics committee monitors compliance with the company’s social and ethical responsibilities, including social and economic development, labour and employment, the environment, stakeholder engagement and good corporate citizenship.

At an operational level, Stor-Age ensures stringent guidelines are implemented and managed to control our risk and ensure that high levels of health and safety, as well as Stor-Age’s own standards, are maintained.

Key areas of focus during the year included compliance with BBBEE and the Property Sector Code. Developments in the Protection of Personal Information Act and Consumer Protection Act remain areas of focus in the upcoming year.