What we do

Our Trading Portfolio comprises 63 self storage properties across South Africa and the United Kingdom, with a combined value of over R4.9 billion.

Stor-Age owns and operates 50 of these properties, covering 321 000 m² GLA – our Listed Portfolio. Stor-Age’s other 13 properties cover 84 000 m² GLA and make up our Managed Portfolio, from which we receive property and asset management fees. Stor-Age holds a pre-emptive right to acquire all properties in the Managed Portfolio, representing a significant growth pipeline.

We manage more than 29 500 individual leases in our Trading Portfolio. In South Africa we experience a churn rate of approximately 5% per month and benefit from more than 1 500 new tenants moving in on average every month. In the UK we experience a churn rate of approximately 8% per month and benefit from more than 550 new tenants moving in every month.

Our average unit size in the UK (6 m2) is considerably smaller than our average size in South Africa (13 m2). The smaller average unit size in the UK contributes directly to the higher churn rate of 8%.

Developing and acquiring properties

Acquisition capability

Our leading corporate platform, skilled operational management team, industry relationships, and specialist sector experience ensure that Stor-Age is well-positioned to identify and capitalise on strategic acquisition and development opportunities with attractive growth potential. This is reflected by our successful acquisitions since listing.

Our ability to close transactions and integrate trading stores seamlessly onto the Stor-Age operating platform has been consistently demonstrated. Since the start of 2017, we successfully completed five transactions to complement our ongoing success in the South African market. This includes three significant multi-property transactions, including the offshore acquisition of Storage King in November 2017.

We continue to improve our operating platform and infrastructure to maximise revenue, reduce costs and ultimately deliver enhanced returns. At a property level, our people and the high-quality, secure and convenient space offered by our portfolio attract and retain a diverse customer base.

Third largest self storage operator in South Africa

Portfolio of six properties – 41 800 m2 GLA

Acquisition completed February 2017

Largest self storage operator in KwaZulu-Natal

Portfolio of four properties – 22 400 m2+ GLA

Acquisition completed November 2017

Sixth largest self storage brand in the United Kingdom

Portfolio of 14 properties – 57 000 m2 GLA

Additional 12 properties trade under the licence of Storage King

Acquisition completed November 2017

Developments

Stor-Age develops investment-grade self storage properties in visible, convenient and accessible locations where there are favourable demographics and where suitable acquisitions are not available. The decision is based on the cost of development versus the cost of acquisition, the demographic market analysis and the existence of barriers to entry. Our model for rolling out new properties and expanding existing ones is well developed with clearly defined key success criteria.

During the year, we opened a high-profile Big Box property in Randburg as part of the Managed Portfolio. This property will offer 7 000 m2 + GLA on full fit-out. We also began construction of two new properties in Bryanston and Craighall Park using the Certificate of Practical Completion (“CPC”) model. On completion, both of the properties will offer a combined 12 750 m2 GLA on full fit-out. The CPC model will see Stor-Age assuming beneficial ownership of each of the properties developed on this model on the day of their opening.

Read more about the CPC model in the CEO’s report.

Barriers to entry and defensive nature of our portfolio

The barriers to new supply in key target nodes are significant. The industry was historically positioned in industrial or urban-edge areas. As a result, there are limited premium grade self storage assets in prime urban and suburban nodes where population density and average household income are key.

Town planning presents a major challenge with long lead times required to gain planning consents. This, in addition to the long lease-up period (financing cost implications) required to reach stabilised occupancy at new stores, is a significant barrier to entry and contributes to the defensive nature of our portfolio.

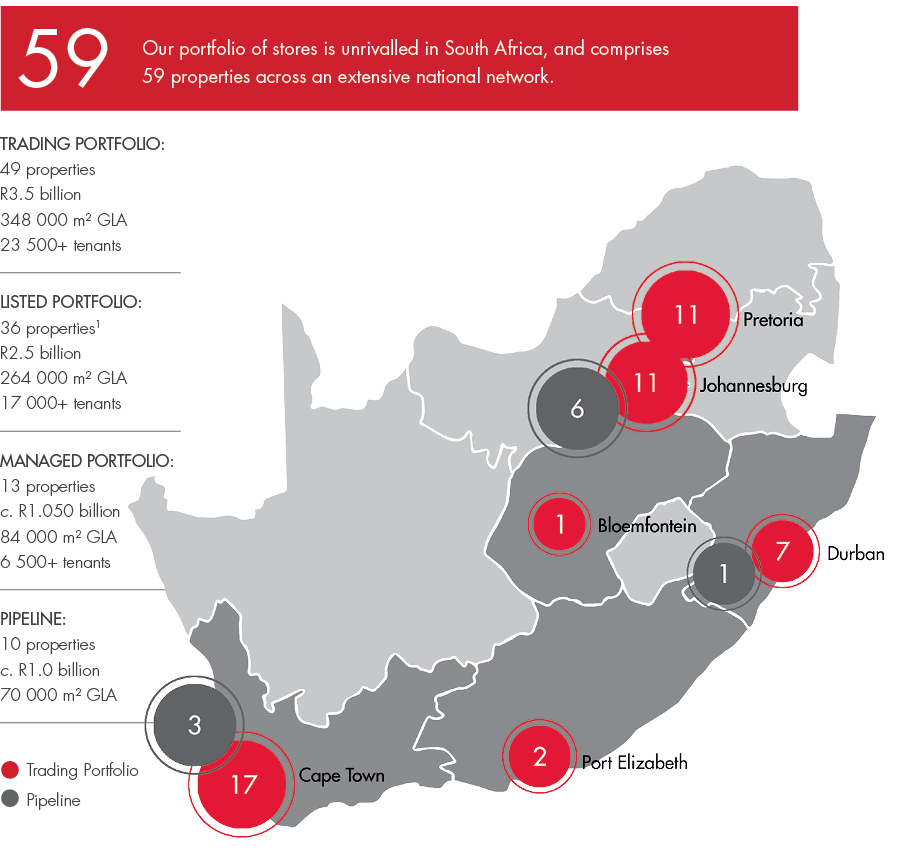

Our property portfolio in South Africa

Our South African portfolio is predominantly purpose built with a national footprint. The 59 properties are split between 49 trading properties and 10 new developments in our pipeline. Our 49 trading properties will offer an estimated 346 000 m² GLA once fully fitted-out. Our pipeline of 10 new properties offers further GLA of 70 000 m² on full build-out.

In defining our property strategy in South Africa, we identified the four main cities on which to focus and then the specific suburbs (including arterial routes) where we would like to establish a presence. This is not a restrictive or instructive strategy, but rather a guide that supports our full business growth strategy.

and comprises 59 properties across an

extensive national network.

TRADING PORTFOLIO:

49 properties

R3.5 billion

348 000 m² GLA

23 500+ tenants

LISTED PORTFOLIO:

36 properties1

R2.5 billion

264 000 m² GLA

17 000+ tenants

MANAGED PORTFOLIO:

13 properties

c. R1.050 billion

84 000 m² GLA

6 500+ tenants

PIPELINE:

10 properties

c. R1.0 billion

70 000 m² GLA

Select a region on the map to view our stores

Western Cape

Listed Property Portfolio

Address: Cnr of Peter

Barlow and

Kasselsvlei Road,

Bellville, Cape Town

GLA m2: 5 874

Value R’000: 63 900

Listed Property Portfolio

Address: 255

Voortrekker Road,

Maitland, Cape

Town

GLA m2: 1 556

Value R’000: 18 507

Managed Property Portfolio

Address: Cnr of Main

Road & Brooke Street,

Claremont, Cape Town

GLA m2: 8 134

GLA (full capacity) m2:

8 091

Listed Property Portfolio

Address: Cnr of

Pinehurst Drive

and Okavango

Road, Pinehurst,

Cape Town

GLA m2: 10 649

Value R’000: 120 000

Listed Property Portfolio

Address: 4 Plein

Street,

Durbanville, Cape

Town

GLA m2: 7 811

Value R’000: 88 000

Listed Property Portfolio

Address: 1 Southdale

Road

Edgemead, Cape Town

GLA m2: 6 719

Value R’000: 54 376

Listed Property Portfolio

Address: 121 Roeland

Street,

Gardens, Cape Town

GLA m2: 11 090

Value R’000: 238 750

Listed Property Portfolio

Address: Cnr Bloemhof

Avenue and

Springfield Street,

Ottery,

Cape Town

GLA m2: 5 356

Value R’000: 44 700

Listed Property Portfolio

Address: 67 Regent

Road,

Sea Point, Cape Town

GLA m2: 2 756

Value R’000: 59 000

Listed Property Portfolio

Address: 42 Delson

Circle,

Somerset West, Cape Town

GLA m2: 5 001

Value R’000: 46 700

Managed Property Portfolio

Address: Cnr Forsyth

Road & De Beers Avenue,

Somerset West, Cape town

GLA m2: 5 507

GLA (full capacity) m2:

5 507

Listed Property Portfolio

Address: 24 Ou

Paardevlei Road,

Somerset West,

Cape Town

GLA m2: 7 720

Value R’000: 96 000

Listed Property Portfolio

Address: 7 George Blake

Street

and 6 Stoffel Smit

Street,

Stellenbosch

GLA m2: 6 247

Value R’000: 80 000

Listed Property Portfolio

Address: 121 Koeberg

Road,

Corner of Koeberg and

Blaauwberg

Road, Table View,

Cape Town

GLA m2: 10 114

Value R’000: 127 000

Listed Property Portfolio

Address: 64-74 White

Road,

Retreat, Cape Town

GLA m2: 8 129

Value R’000: 113 000

Managed Property Portfolio

Address: 37 Informal

Road, Westlake, Cape Town

GLA m2: 2 249

GLA (full capacity) m2:

2 249

Gauteng

Listed Property Portfolio

Address: 37 View Point

Road, Bartlett, Boksburg,

Johannesburg

GLA m2: 7 229

Value R’000: 71 000

Managed Property Portfolio

Address: Cnr of Jan

Shoba & Justice Mohamed Street,

Brooklyn, Pretoria

GLA m2: 7 022

GLA (full capacity) m2:

7 582

Listed Property Portfolio

Address: Cnr of Hendrik

Potgieter and 14th Avenue,

Constantia Kloof, Johannesburg

GLA m2: 5 375

Value R’000: 79 167

Listed Property Portfolio

Address: 17 JG Strydom

Drive, Constantia Kloof,

Johannesburg

GLA m2: 7 977

Value R’000: 95 000

Listed Property Portfolio

Address: Plot 13

Garsfontein Road, Grootfontein,

Pretoria

GLA m2: 9 711

Value R’000: 44 500

Managed Property Portfolio

Address: 60 Civin Drive

Germinston, Johannesburg

GLA m2: 8 517

GLA (full capacity) m2:

8 596

Listed Property Portfolio

Address: Jakaranda

Street, Hennopspark, Pretoria

GLA m2: 9 387

Value R’000: 70 500

Managed Property Portfolio

Address: Cnr of 40th

Avenue & 24th Street, Irene,

Pretoria

GLA m2: 5 033

GLA (full capacity) m2:

6 000

Listed Property Portfolio

Address: 32

Rosettenville Road, Village Main,

Jhb City, Johannesburg

GLA m2: 7 848

Value R’000: 56 500

Listed Property Portfolio

Address: Cnr of Cheetah

and Klipspringer Street, Kempton

Park, Johannesburg

GLA m2: 9 214

Value R’000: 75 000

Listed Property Portfolio

Address: 1250 Theron

Street, Pierre van Rhyneveld,

Pretoria

GLA m2: 20 919

Value R’000: 133 500

Listed Property Portfolio

Address: 492 Komondor

Road, Glen Austin X3, Midrand,

Johannesburg

GLA m2: 7 248

Value R’000: 53 000

Listed Property Portfolio

Address: 65 Freight

Road, Cnr of Old Johannesburg and

Brakfontein, Louwlardia Ext 13,

Centurion, Pretoria

GLA m2: 7 597

Value R’000: 83 000

Listed Property Portfolio

Address: 39 Tulip

Avenue, Raslow, Pretoria

GLA m2: 8 248

Value R’000: 42 000

Managed Property Portfolio

Address: 738 Blesbok

Street Pretoria East

GLA m2: 5 525

GLA (full capacity) m2:

7 500

Listed Property Portfolio

Address: 1384 Malie

Street, Pretoria West

GLA m2: 4 161

Value R’000: 11 550

Listed Property Portfolio

Address: 225 Braam

Fischer Drive, Randburg,

Johannesburg

GLA m2: 7 332

Value R’000: XX

Listed Property Portfolio

Address: 29 Rietspruit

Rd, Samrand, Pretoria

GLA m2: 7 978

Value R’000: 53 900

Managed Property Portfolio

Address: Six Fountains

Boulevard off Hans Strijdom Drive,

Six Fountains, Pretoria

GLA m2: 7 687

GLA (full capacity) m2:

9 096

Managed Property Portfolio

Address: 4 Kikuyu Road,

Sunninghill, Johannesburg

GLA m2: 7 781

GLA (full capacity) m2:

7 500

Listed Property Portfolio

Address: Portion 610,

St Antonios Road, Muldersdrift,

Johannesburg

GLA m2: 5 788

Value R’000: 20 107

Listed Property Portfolio

Address: 70 Migmatite

Street, Zwartkop Ext 13,

Pretoria

GLA m2: 9 319

Value R’000: 62 500

Free State

Listed Property Portfolio

Address: Sand Du

Plessis Avenue, Estoire,

Bloemfontein

GLA m2: 6 679

Value R’000: 25 700

Kwa-Zulu Natal

Managed Property Portfolio

Address: 23 Calder

Road, Berea. Durban

GLA m2: 8 160

GLA (full capacity) m2:

8 354

Managed Property Portfolio

Address: 33 Flanders

Drive, Mount Edgecombe, Durban

GLA m2: 8 632

GLA (full capacity) m2:

8 755

Managed Property Portfolio

Address: 200 Gale

Steet, Durban

GLA m2: 3 469

Value R’000: 21 500

Managed Property Portfolio

Address: 2014 Old North

Coast Rd, Mt Edgecombe

GLA m2: 3 782

Value R’000: 26 600

Listed Property Portfolio

Address: 166 Intersite

Avenue, Umgeni Business Park, Durban

GLA m2: 5 516

Value R’000: 41 500

Managed Property Portfolio

Address: 1 Nguni Way,

Hillcrest

GLA m2: 15 115

Value R’000: 110 000

Eastern Cape

Listed Property Portfolio

Address: Plot 136 Old

Cape Road, Port Elizabeth

GLA m2: 11 032

Value R’000: 59 000

Managed Property Portfolio

Address: 85 Warbler

Road, Westering, Port Elizabeth

GLA m2: 6 826

GLA (full capacity) m2:

9 393

| 1 | Includes All-Store – acquired 6 April 2018 |

Maintaining our properties

As a customer-facing real estate business, it is paramount to maintain the quality of our assets by investing in a rolling programme of preventative maintenance, store cleaning and the repair and replacement of essential equipment.

We have a bespoke, online-based Facilities Management System for store-based employees to log, track and manage all maintenance requests until closed. In conjunction with our store-based employees and area managers, our national facilities manager and city-based regional facilities managers oversee property maintenance with the assistance of dedicated facilities teams in each city.